Planning Your Savings

- Health & Well-being

-

Agricultural Programs

- Agribusiness

- Animal Science

- Beginning Farmer Program

- Commercial Crops

- Commericial Horticulture

- Delaware Soil Testing Program

- Disease Management

- Farm Vitality and Health Project

- Irrigation

- Nutrient Management

-

Insect Pest Management

- Insect Trapping Program

- IPM Hot Topics

- Commercial Field Crop Insect Management

- Commercial Field Crop Disease Management

- Commercial Fruit & Vegetable Crop Pest Management

- EIPM Implementation Projects

- Pollinators

- Research and Extension Demonstration Results

- Brown Marmorated Stink Bug (BMSB) Management, Research, and Resources

- Publications

- Pesticide Safety Education Program

- UD Plant Diagnostic Clinic

- Variety Trials

- Weed Science

- Certified Crop Advisor Program

- Poultry Biosecurity

- 4-H

-

Horticulture

- Climate Variability and Change

- Delaware Soil Testing Program

- Forestry

- Lawn and Garden

- Master Gardeners

- Master Naturalist Program

-

Nutrient Management

- Nutrient Management Certification

- Continuing Education for Nutrient Management

- Nutrient Management Planning Resources

- Commercial Nutrient Handler Resources

- Poultry Litter and Manure Management

- Turf Management

- Agriculture Notebook

- Horticulture Handbook

- Agriculture & Horticulture Handbooks

- Crop Production

- Soil Fertility

- Delaware Climate Change Coordination Initiative (DECCCI)

- Salt Impacted Agricultural Lands

Planning your savings helps to achieve your goals

By Maria Pippidis

We all have goals we want to achieve. Unfortunately, whether you’re paying down debt, purchasing a new appliance, going on vacation or saving for retirement, many of these goals require money. That’s why connecting your spending and saving actions to your goals can help you improve your chances of success! But you need to plan.

Whether you are automatically depositing money into a savings or retirement account or using cash instead of credit (a good tip for those watching their spending), a solid plan for saving money is just a few steps away!

Step 1

Luckily, it’s easy to get started! Setting goals is the first step toward financial independence. List your goals before trying to come up with a battle plan—that will be step two.

Step 2

Once you’re ready to move on, you can begin to identify simple ways to approach saving money towards each goal. Aim for small changes that you can observe the effectiveness of in daily life.

If you are struggling with overspending at the store, try using cash or debit instead of your credit card. When you can see the money leaving your hand (or account!), you become more aware of the amount you’re actually spending.

If your goal is to spend less on takeout and school lunches, set aside each Sunday afternoon to prepare food for the week ahead. Not only will you find ways to use up your groceries before they expire, but you’ll also have an excellent excuse to opt-out of the office take out order. As a bonus, this is an easy way to spend some quality time with the family.

And finally, to visualize how your efforts are paying off, try setting up separate savings accounts for each goal and automatically depositing money with each paycheck. As you watch that vacation fund grow, you’ll be able to see a future where your goal is a reality.

There is no “correct” way to save. The bottom line is this: if a particular approach fits your lifestyle, go for it!

#AmericaSavesWeek

Now is the perfect time to jump-start your goals! February 24 to 29, 2020, is #AmericaSavesWeek! Take a little time during this week to jot down your goals and possible approaches to achieving them. Then once a month, take a little time to revisit that plan and see how you’re doing and where you can adjust. Even if you don't choose an effective approach the first time, try something else! Remember that your financial health, both now and in the future, is important.

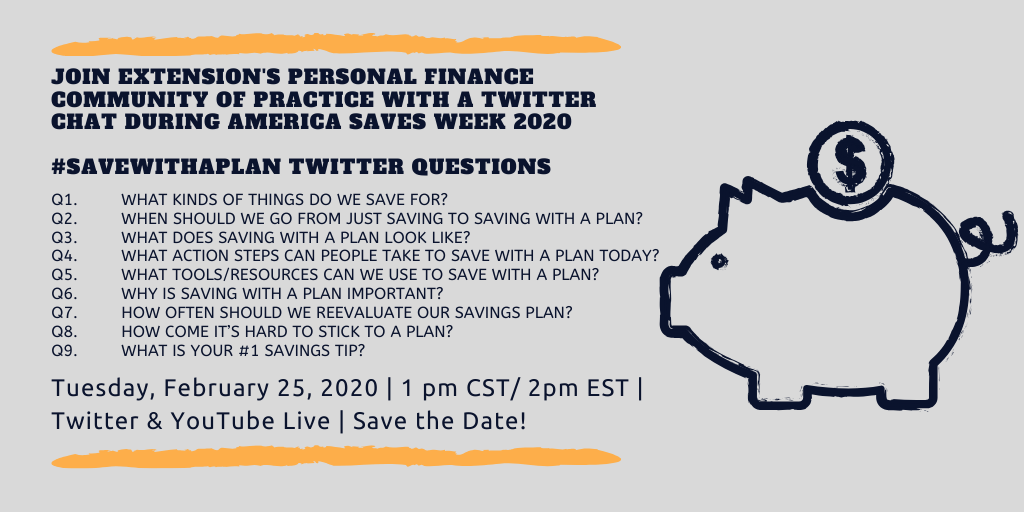

In honor of #AmericaSavesWeek, Cooperative Extension’s National Financial Security for All team is hosting a Twitter chat and YouTube live session on February 25, 2020 at 2 p.m. EST. Join in for additional ideas on planning for your savings goals! Use the hashtag #exaschat on Twitter to join the conversation and tune into Youtube Live for the answers!

In the meantime, check out Where Can I Find $2,000? for more savings tips!

The University of Delaware is an Equal Opportunity Institution and Provider. Visit UD’s Office of Equity & Inclusion to learn more.

Additional Links

531 South College Avenue Newark, DE 19716 (302) 831-2501