Creating Lasting Financial Well-Being for Adults (2025)

Creating Lasting Financial Well-Being for Adults (2025)

Written by: Kelly Sipple

RELEVANCE

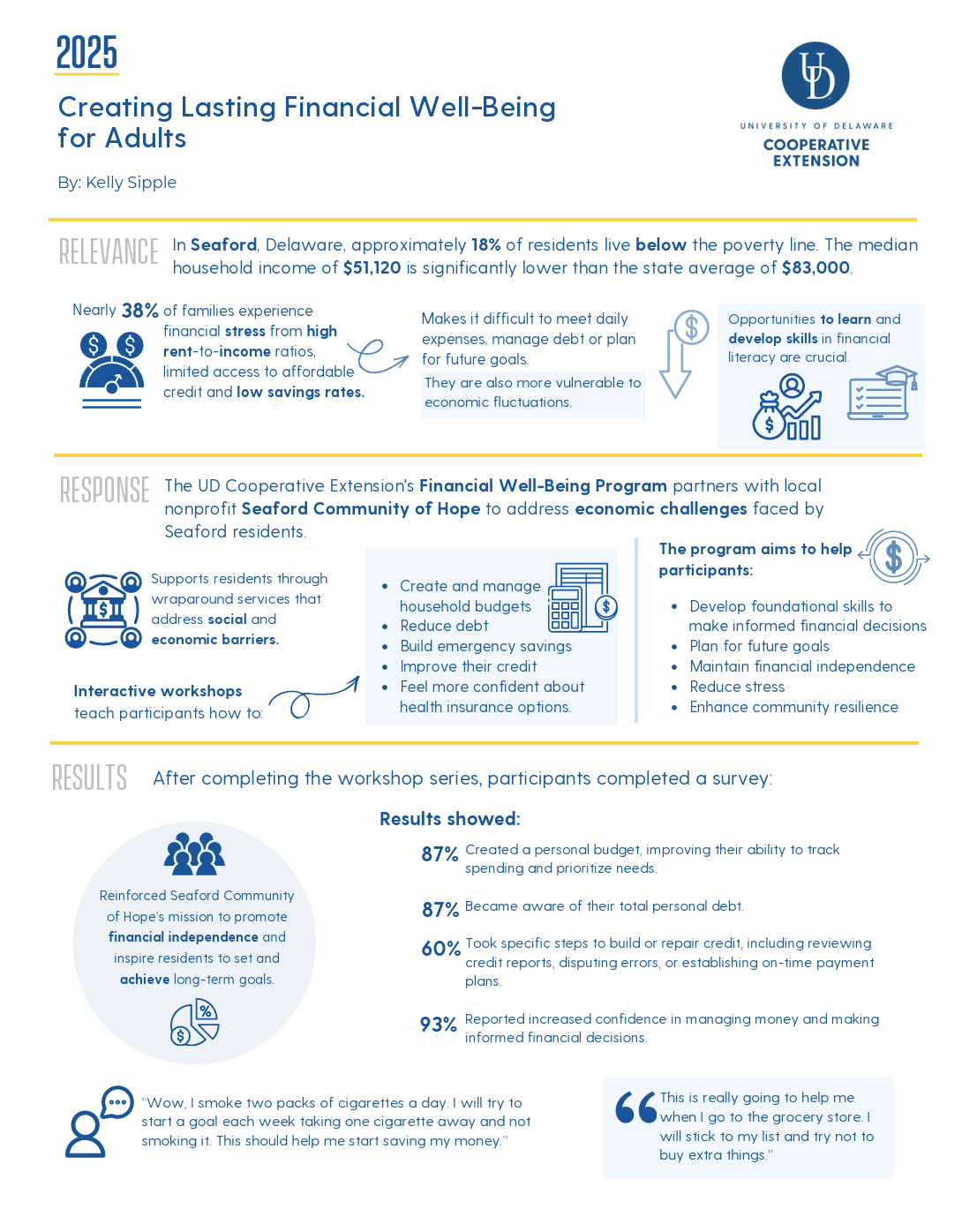

In Seaford, Delaware, approximately 18% of residents live below the poverty line. The median household income of $51,120 is significantly lower than the state average of $83,000. Nearly 38% of families experience financial stress from high rent-to-income ratios, limited access to affordable credit and low savings rates. These conditions make it difficult for individuals to meet daily expenses, manage debt or plan for future goals. They are also more vulnerable to economic fluctuations. Opportunities to learn and develop skills in financial literacy are crucial for both individual and community stability and resilience.

RESPONSE

The University of Delaware Cooperative Extension's Financial Well-Being Program partners with local nonprofit Seaford Community of Hope to address economic challenges faced by Seaford residents. The nonprofit supports residents through wraparound services that address social and economic barriers, offering a continuum of care that empowers residents to move from financial crisis to long-term independence. Interactive workshops teach participants how to create and manage household budgets, reduce debt, build emergency savings, improve their credit, and feel more confident about health insurance options. The program aims to help participants develop foundational skills to make informed financial decisions, plan for future goals, maintain financial independence, reduce stress, and enhance community resilience.

RESULTS

After completing the workshop series, participants completed a survey:

- 87% created a personal budget, improving their ability to track spending and prioritize needs.

- 87% became aware of their total personal debt.

- 60% took specific steps to build or repair credit, including reviewing credit reports, disputing errors, or establishing on-time payment plans.

- 93% reported increased confidence in managing money and making informed financial decisions.

Beyond improving individual outcomes, the program also benefited the community. It reinforced Seaford Community of Hope’s mission to promote financial independence and inspire residents to set and achieve long-term goals. One participant shared, “This is really going to help me when I go to the grocery store. I will stick to my list and try not to buy extra things.” Another participant reflected on taking a small step to improve health: “Wow, I smoke two packs of cigarettes a day. I will try to start a goal each week taking one cigarette away and not smoking it. This should help me start saving my money.” A third participant shared, “This has been very helpful with trying to get a handle on where my money is going." This program provides adult learners with the knowledge, confidence, and practical tools to enhance their financial stability and overall quality of life.

RECOGNITION

Our partner on this project was Seaford Community of Hope.

PUBLIC VALUE STATEMENT

The Financial Well-Being Program, collaborating with the Seaford Community of Hope, enhances Seaford’s economic resilience by equipping adults with essential skills in money management, budgeting, and savings. By helping residents build confidence and financial stability, the program reduces financial stress, supports stronger families, and contributes to a more self-sufficient and hopeful community.