Form 1098-T

Form 1098-T Information

The University of Delaware is not qualified to provide legal and/or tax advice. The information provided may or may not reflect recent revisions in IRS regulations. For tax advice on your specific situation, contact a tax professional.

1098-T OVERVIEW

The IRS Fom 1098-T is used to assist students and families in taking advantage of education credits. The IRS requires the University of Delaware to provide the form for nearly all students who pay Qualified Tuition and Related Expenses (QTRE) in a given tax year. Exceptions include international students, students in courses not for academic credit, and students who have no payments toward qualified charges or for whom grants and scholarships offset those charges.

The information listed on the IRS form 1098-T may differ from the amount students/families actually paid toward QRTE. We strongly recommend seeking professional assistance when claiming an education tax credit. Regardless of the information provided on the 1098-T, and even if reporting only what is on Form 1098-T, students/families claiming education credits should always keep documentation (e.g., invoices and payment receipts) that support any claimed tax credit.

The extent of tax information the University of Delaware can provide legally is included directly on the 1098-T, is included on this website, or is available at askSFS using keyword search 1098T. We are not permitted to discuss tax implications, discuss how this form may relate to individual students/families, or provide tax advice. Please consult your tax preparer with all questions related to this document.

Also note that IRS Publication 970 states: "The amount on form 1098-T might be different from the amount you actually paid and are deemed to have paid." Further, IRS Form 8863 instructions state: "The amount of qualified tuition and related expenses reported on Form 1098-T may not reflect the total amount of qualified tuition and related expenses paid during the year for which you may claim the tax credit. You may include qualified tuition and related expenses that are not reported on IRS form 1098-T when claiming one of the related credits if you can substantiate payment of these expenses."

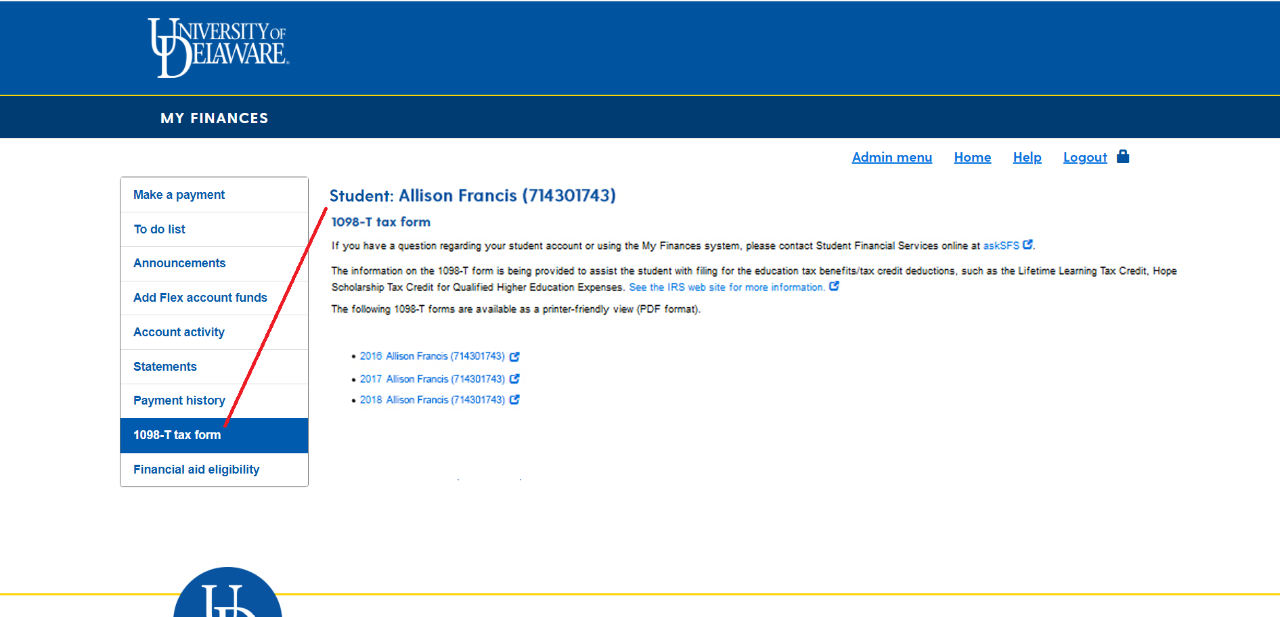

Available in My Finances

1098-T forms for the previous calendar (tax) year will be available in My Finances no later than January 31. Students can log in to view and print the form to provide it, if applicable, to those eligible to claim them as a dependent. Forms will not be mailed and, per FERPA regulations, UD can only provide 1098-T forms directly to students.

The forms will only be available to students who meet the following criteria:

- Maintain a valid, active home or mailing address in UDSIS

- Have paid tax-reportable tuition, fees, or financial aid transactions to the student account during the reported calendar year (including prior year adjustments)

Reporting Method

UD reports qualified payments in Box 1 on the 1098-T., as the federal government no longer allows the University to report qualified expenses in Box 2 (effective tax year 2018).

Inclusions

- Paid tuition

- Paid mandatory student fees (excluding Student Health Service Fee)

- Paid course/lab fees

- Scholarships

- Grants

Exceptions

- Student loan interest - if applicable, loan provider will issue tax statements for deductible loan interest

- Housing and food expenses

- Fines (such as parking, library, or late fees)

- Tuition and fees for non-credit courses

- Books - book costs and payments are usually tax deductible, but UD does not post those charges to student accounts, so students should keep invoices and receipts of those transactions for their own tax records.

Prior Year Adjustments

- Items that have been reversed will appear in applicable prior-year boxes (4 or 6).

- Reassessed items will appear in the applicable reporting-year boxes (1 or 5).

- Revised items will appear in the applicable prior-year AND reporting-year boxes (1 and 4 or 5 and 6).

Other Resources

UD does not provide tax advice. Please consult a tax expert for 1098-T and other tax advice. Additional assistance may be found by visiting the following.

- Tax Benefits for Education Information Center

- About Form 1098-T, Tuition Statement

- For UD's Frequently Asked Questions regarding the 1098T or to contact us online, visit askSFS.