ADVERTISEMENT

- Rozovsky wins prestigious NSF Early Career Award

- UD students meet alumni, experience 'closing bell' at NYSE

- Newark Police seek assistance in identifying suspects in robbery

- Rivlin says bipartisan budget action, stronger budget rules key to reversing debt

- Stink bugs shouldn't pose problem until late summer

- Gao to honor Placido Domingo in Washington performance

- Adopt-A-Highway project keeps Lewes road clean

- WVUD's Radiothon fundraiser runs April 1-10

- W.D. Snodgrass Symposium to honor Pulitzer winner

- New guide helps cancer patients manage symptoms

- UD in the News, March 25, 2011

- For the Record, March 25, 2011

- Public opinion expert discusses world views of U.S. in Global Agenda series

- Congressional delegation, dean laud Center for Community Research and Service program

- Center for Political Communication sets symposium on politics, entertainment

- Students work to raise funds, awareness of domestic violence

- Equestrian team wins regional championship in Western riding

- Markell, Harker stress importance of agriculture to Delaware's economy

- Carol A. Ammon MBA Case Competition winners announced

- Prof presents blood-clotting studies at Gordon Research Conference

- Sexual Assault Awareness Month events, programs announced

- Stay connected with Sea Grant, CEOE e-newsletter

- A message to UD regarding the tragedy in Japan

- More News >>

- March 31-May 14: REP stages Neil Simon's 'The Good Doctor'

- April 2: Newark plans annual 'wine and dine'

- April 5: Expert perspective on U.S. health care

- April 5: Comedian Ace Guillen to visit Scrounge

- April 6, May 4: School of Nursing sponsors research lecture series

- April 6-May 4: Confucius Institute presents Chinese Film Series on Wednesdays

- April 6: IPCC's Pachauri to discuss sustainable development in DENIN Dialogue Series

- April 7: 'WVUDstock' radiothon concert announced

- April 8: English Language Institute presents 'Arts in Translation'

- April 9: Green and Healthy Living Expo planned at The Bob

- April 9: Center for Political Communication to host Onion editor

- April 10: Alumni Easter Egg-stravaganza planned

- April 11: CDS session to focus on visual assistive technologies

- April 12: T.J. Stiles to speak at UDLA annual dinner

- April 15, 16: Annual UD push lawnmower tune-up scheduled

- April 15, 16: Master Players series presents iMusic 4, China Magpie

- April 15, 16: Delaware Symphony, UD chorus to perform Mahler work

- April 18: Former NFL Coach Bill Cowher featured in UD Speaks

- April 21-24: Sesame Street Live brings Elmo and friends to The Bob

- April 30: Save the date for Ag Day 2011 at UD

- April 30: Symposium to consider 'Frontiers at the Chemistry-Biology Interface'

- April 30-May 1: Relay for Life set at Delaware Field House

- May 4: Delaware Membrane Protein Symposium announced

- May 5: Northwestern University's Leon Keer to deliver Kerr lecture

- May 7: Women's volleyball team to host second annual Spring Fling

- Through May 3: SPPA announces speakers for 10th annual lecture series

- Through May 4: Global Agenda sees U.S. through others' eyes; World Bank president to speak

- Through May 4: 'Research on Race, Ethnicity, Culture' topic of series

- Through May 9: Black American Studies announces lecture series

- Through May 11: 'Challenges in Jewish Culture' lecture series announced

- Through May 11: Area Studies research featured in speaker series

- Through June 5: 'Andy Warhol: Behind the Camera' on view in Old College Gallery

- Through July 15: 'Bodyscapes' on view at Mechanical Hall Gallery

- More What's Happening >>

- UD calendar >>

- Middle States evaluation team on campus April 5

- Phipps named HR Liaison of the Quarter

- Senior wins iPad for participating in assessment study

- April 19: Procurement Services schedules information sessions

- UD Bookstore announces spring break hours

- HealthyU Wellness Program encourages employees to 'Step into Spring'

- April 8-29: Faculty roundtable series considers student engagement

- GRE is changing; learn more at April 15 info session

- April 30: UD Evening with Blue Rocks set for employees

- Morris Library to be open 24/7 during final exams

- More Campus FYI >>

Editor's Note: Video from this conference is available on a special Academic Technology Services Web site.

4:17 p.m., Nov. 10, 2009----“Creating New Economies for Delaware, the Region and the Nation” was the focus of a special conference held Monday and Tuesday, Nov.9-10, at the University of Delaware's Clayton Hall.

Keynote speakers and panelists included the economic adviser for Vice President Joe Biden, Delaware's congressional delegation, CEOs of DuPont, ING, Gore and Wilmington Trust, the chief investment strategist for Charles Schwab and several state officials, including Gov. Jack Markell.

While many government and business leaders differ on how to lead the state and the nation from the depths of the worst recession since the Great Depression, most who spoke during the conference - the latest in a University-sponsored series on creating knowledge-based partnerships -- appeared to agree that a business-as-usual approach is not a viable path to a sustainable economic recovery.

In welcoming attendees and panel participants Monday morning, UD President Patrick Harker noted that recovery from such a severe recession demands a collective effort from government, business and educational institutions.

“We must contribute to the creation and dispersion of new knowledge to ensure Delaware's economic development and vitality,” Harker said. “We're no longer expected just merely to innovate, but to connect those innovations with industry, to patent and license inventions, to launch and nurture new firms, to conduct collaborative research and cultivate academic fields that contribute to technological advance.”

A view from the U.S. Senate

In his keynote remarks on recession and recovery, U.S. Senator Thomas R. Carper (D-Del.) said he wanted to address “how we got into this mess, the steps we took to pull back from the abyss, how we are doing now, and when do we take our foot off the accelerator.”

“About a year ago we just finished doubling the nation's debt in eight years, GM and Chrysler were bleeding red, and the bottom fell out of the economy,” Carper said. “We got used to living beyond our means, and there were new mortgage products that were given to people who would never be able to pay for them.”

Carper acknowledged the importance of the University of Delaware in contributing to economic recovery and the creation of sustainable well paying jobs in the future.

“The University of Delaware is going to be a big part in leading our economic engine to help pull us through,” Carper said. “It's a role that the University has played in times in the past, and more than ever, it is a role we need the University to play today.”

A crucial element in stabilizing an economy that appeared to be in freefall, Carper said, was letting Americans know that the money they had placed in bank accounts remained secure.

“Through the Federal Deposit Insurance Commission, Americans were assured that their money in banks is backed by the U.S. Government,” Carper said. “While 100 banks closed in 2009, some of our largest banks have accumulated large amounts of money to strengthen their position.”

Despite what Carper called an unacceptable unemployment rate of 10.2 percent, there are some signs that the economy has pulled back from the precipice and may be taking modest steps toward recovery.

“We were told that we needed to do something big, and I think the stimulus money (American Recovery and Reinvestment Act of 2009) is having a buoying effect,” Caper said. “The stimulus was tailor-made for Delaware and helped to balance the budget and helped avoid laying off hundreds of teachers. It really helped the state to get through a difficult time.”

Carper also used a quote attributed to Albert Einstein, that “in adversity lies opportunity,” to note that America must take steps to reduce a record trade deficit, lessen dependence on fossil fuels and develop new Earth-friendly technologies for home use and export abroad.

“We have always been leaders, not followers,” Carper said. “We need to harness the greatest source of leadership in the county, which is American ingenuity.”

Panel on 'Reframing the U.S. Economy'

The first panel discussion of the conference, “Reframing the U.S. Economy,” was held Monday morning and moderated by John Taylor, executive director of the Delaware Public Policy Institute.

Panelists included Arkadi Kuhlman, chairman and CEO of ING Direct, Ellen Kullman, CEO of DuPont, and William Poole, UD Distinguished Scholar in Residence and former president of the Federal Reserve Bank of St. Louis.

Carper's remarks drew a mixed reaction from panel members that reflected their expertise and experience in the fields of finance, business and higher education.

“I liked Sen. Carper's remarks about American ingenuity. The question is, how do we create a new intellectual environment?” ING's Kuhlman said. “The Founding Fathers of the United States dealt in terms of principles and what is right and what is wrong. American business leaders should be asking, is this the right thing to do?”

As the leader of one of the nation's oldest corporations, DuPont CEO Kullman said that “it will be a long time until we get back to whatever the 'new normal' will be.”

“We cannot sustain our economic growth without being a manufacturing country,” Kullman. “We also need students with strong math and science skills. There is a tremendous difference between America and other countries, and we have to start this education in kindergarten.”

While UD's Poole agreed that action was needed to advert total financial catastrophe, he disagreed with the size of the government response. “We are watching a federal fiscal train wreck,” Poole said. “We need more business investment to drive technology, with the federal government focusing only on research projects.”

Looking at 'New Directions for U.S. Prosperity'

Jared Bernstein, chief economist to Vice President Joe Biden, said in his talk “Starting the Virtuous Cycle” - part of a talk and panel response on “New Directions for U.S. Prosperity” -- that it has been exciting to serve on the economic team of President Barack Obama, and that the president “really gets the level of the economic problems we face.”

“The magnitude of how this downturn is playing out can be seen in the lives of the average American family,” Bernstein said. “Job growth is typically preceded by economic growth. The rate of job losses has decelerated, and employers have added 34,000 temporary employees.”

Bernstein said the Obama Administration and Congress recently extended unemployment insurance and have extended homebuyer credit to help deal with a 10.2 percent unemployment rate.

“Double digit unemployment recessions with financial overlay are particularly tough to crack, and downturns caused by financial markets are particularly hard to get out of,” Bernstein said. “We have an economy that is 70 percent based on consumer consumption, and there is still a reluctance among banks to loan and invest.”

Bernstein called for a strong reform agenda that draws on the entrepreneurial strengths of the small business sector combined with a strong flow of American capital and labor throughout the world, but noted that any recovery has to follow an economic stabilization and prevention of further economic decline.

“There is no virtuous cycle possible if you are stuck in the middle of a great recession,” Bernstein said. “The fiscal stimulus plan has been extremely important, but no considerable stimulus could offset the job losses we see now. If we had failed to enact the stimulus, the recession could have morphed into a depression.”

A panel responded to Bernstein's comments, and U.S. Rep. Michael N. Castle (R-Del.) said that while he supports some stimulus, especially in terms of infrastructure improvements, he is concerned over the total cost and just how effective it will be in the long term.

“My major concern with the stimulus package is the relatively short-term aspect of it,” Castle said. “What is going to happen after the next three or four months?”

Laurence Seidman, Chaplin Tyler Professor of Economics at UD, said that while fiscal oversight is necessary in normal times, more stimulus spending is necessary in times of economic emergencies. “When you are in a recession and you have more government fiscal spending, you get more consumer spending,” he said.

From a corporate standpoint, the quality of the money invested in things like research and development is critical, Terri Kelly, CEO of W.L. Gore and Associates, said. “We spend 8 percent of our budget on research and development. You have to be very strict about where you spend that money.”

UD alum Sonders cautiously optimistic

As the chief investment strategist for Charles Schwab & Co., Liz Ann Sonders considers herself “neither a perma-bull nor a perma-bear” but says her current view of the economy provides several reasons for cautious optimism.

Sonders, who also is senior vice president with Schwab and who earned her bachelor's degree in economics and political science from the University of Delaware in 1986, was the lunchtime keynote speaker Monday. She told the audience that her role as a strategist is to look at the big picture for Schwab's clients, all of whom are individual investors, rather than trying to forecast short-term ups and downs of the stock market.

With unemployment still high and businesses and investors still skeptical about the economic recovery, Sonders said she recognizes that challenges remain. However, she said, she continues to believe that the recession ended in the second quarter of this year and that historical trends support an optimistic outlook.

The market already is improving, she noted, which typically occurs in a recession before other aspects of the economy show signs of turning around.

“Some of the biggest bull markets in history have been born during the depths of recession,” she said. “The market looks ahead at what the economy is going to do, not back at what it's already done.” Investors who delay getting back into the market until employment starts to pick up will have missed most of their chance to benefit from rising stock prices, she predicted.

“Historically, unemployment is low when a recession begins and high when it ends,” Sonders said, adding that the typical lag time for an improvement in employment is six months, with the previous two recessions showing a lag of about a year.

She also pointed out some other signs of economic recovery, including a drop in initial unemployment claims; rises in the manufacturing and service sectors, showing that both are in the early stages of “expansion mode”; and the fact that sharp recessions generally are followed by sharp recoveries.

Because forecasts were so dire a year ago, Sonders said, businesses reacted quickly and drastically, cutting back more than the eventual downturn actually justified. As a result, she said, a kind of “coiled spring” effect could help employment and the economy overall rebound strongly.

At Schwab, Sonders is responsible for market and economic analysis and investor education, writing regular updates and speaking frequently to audiences of clients and the public. Kiplinger's Personal Finance magazine, in its latest issue, named her the nation's best market strategist for 2009. Noting that Sonders warned about the housing market bubble as early as fall 2006, the magazine said she “has proved herself an expert in divining which way the economic winds will blow.”

She is a regular guest on PBS's Wall Street Week and Nightly Business Report and numerous other TV business shows. She has been named one of the most influential people on Wall Street by SmartMoney and in 2005 was appointed to the President's advisory Panel on Federal Tax Reform.

Panel on 'Regional Opportunities, Global Perspectives'

The conference's Monday afternoon sessions featured two panel discussions interspersed by a talk by Gov. Markell.

The first afternoon panel was on “Regional Opportunities and Global Perspectives,” moderated by Conrado (Bobby) Gempesaw, dean of UD's Lerner College of Business and Economics. The panel featured UD alumnus Tevfik Aksoy, chief economist for the Middle East, Turkey and North Africa for Morgan Stanley; Ian McLean, executive vice president of finance and markets for Exelon; and alumnus Stoyan Tenev, lead economist for the East Asia and Pacific region of the World Bank Group's International Finance Corp.

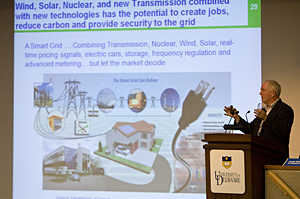

McLean pointed out that energy is central to our lives and discussed the factors surrounding subsidized solar and wind power and nuclear power, saying a combination of all three might be a solution to energy problems. He said he was opposed to bureaucrats making energy decisions and said, “Let the market decide.”

Aksoy discussed emerging world markets and the region he serves in the Middle East, North Africa and Turkey, saying monetary and fiscal policies were important and the “main trigger.” He discussed emerging markets, the effect of oil prices on the economies of countries in the region and also pointed out that many of these countries have young populations.

Tenev discussed China and other Pacific nations in his talk, saying the U.S. and Asia are interdependent. Fiscal stimulus in East Asia has been effective, according to Tenev. He talked about G-2 and the relationship between the U.S. and China, and said China was an economic super power and a significant source of foreign investment in the world.

China, he said, is increasing services and consumption with less dependence on exports.

A view from the governor's office

The panel was followed by a talk by Gov. Jack Markell, who was introduced by Alan Levin, director of the Delaware Economic Development Office. Markell said he was not going to give his prepared speech, but planned to talk informally and interact with the audience.

“Delaware can and must be the best state for business,” Markell said, and be “faster, more responsive and nimble” to businesses needs.

He pointed out the pluses that Delaware has in its favor to attract new businesses -- schools, tax structure, services and quality of life. He cited UD, Delaware State University and Delaware Technical and Community College as being critical to business success in the state.

Markell and Levin are visiting all the businesses in the state. “We care about every job -- every job matters,” he said. “We need your help in identifying unnecessary red tape and also leads concerning businesses that are unhappy, might be expanding, or that might be moving from another state.”

He added that businesses make no money filling out forms and there should be a new attitude toward regulations. “Delaware is open for business,” Markell said.

Panel looks at 'New Economies for Delaware'

A panel, “New Economies for Delaware,” moderated by William Latham, UD professor of economics, followed Markell's speech and featured Christopher Coons, county executive of New Castle County; Robert Harra, president and chief operating officer of Wilmington Trust Corp.; Tom Morr, president of Select Greater Philadelphia; and former Delaware Gov. Pete du Pont.

Discussing the challenges of his term as governor, du Pont recalled that time as one when income taxes were high and there were deficits and unemployment. Spending was held flat, taxes lowered and a state constitutional amendment was added that controlled spending in the Delaware General Assembly.

He also touched on the Financial Center Development Act that liberalized banking laws and attracted large financial institutions to the state.

Morr discussed the tri-state region, including New Castle County, five counties in Pennsylvania and five in New Jersey. It is a powerful region, he said, and a huge economic market. He said the largest economic sector was in the life sciences, followed by financial services.

Harra said Wilmington Trust serves businesses in the mid-Atlantic region from Princeton to Washington, D.C., and is often asked by clients about housing, tax structure, labor pool, schools, traffic and dealing with government. He reviewed the economic downturns that had taken place in the past years and predicted low interest rates would rise and that there would be inflation.

He also said there would be an increase in electronic banking options, such as making deposits from home.

Coons spoke about contributions New Castle County has made to the state, including libraries, parks and police. He also spoke about efforts to balance the budget, maintain the county's bond rating and reduce foreclosures on mortgages. “We have to play together, participate and listen to criticism,” he said.

The million-dollar question

Moderated by Taylor, executive director of the Delaware Public Policy Institute, the plenary roundtable session held Tuesday addressed “Strategies for Delaware Economic Growth.”

Participants included Jeffrey Bullock, Delaware Secretary of State; Joseph DiPinto, director of economic development in Wilmington; Alan Levin, director of the Delaware Economic Development Office; Ed Ratledge, director of UD's Center for Applied Demography and Survey Research; Dennis Rochford, president of the Maritime Exchange for the Delaware River and Bay Authority; Pete Schwartzkopf, majority leader in the Delaware General Assembly's House of Representatives; F. Gary Simpson, minority leader in the state Senate; and Jim Wolfe, president of the Delaware State Chamber of Commerce.

Taylor launched the session by asking Ratledge, “If I gave you a million dollars to change Delaware's economy, where would you spend it?”

“With the change in the state's population structure, healthcare is our fastest-expanding sector,” Ratledge said. “That's where I'd spend it -- on all facets of healthcare, including not only services but also education and translational research.”

Simpson said that he would give the money to David Weir, director of UD's Office of Economic Innovation and Partnership, to build a technology park. “That's the future of Delaware,” he said.

Although Taylor tossed out several other questions, the discussion repeatedly returned to the million-dollar question. Levin said he would spend the funds on advertising to spread the word on what is good about Delaware: a great location, a quality workforce, and a favorable tax structure. “Too often, we dwell on what's wrong,” he said, “but we need to focus on what we're doing right.”

Schwartzkopf, whose state legislative district lies within Sussex County, would spend the money on maintaining and improving the resort area's heavily used infrastructure. “Unless you want your vacation area to turn into what you're escaping from, we have to spend some money there,” he said.

DiPinto would give half of the sum to Levin for his suggested ad campaign and the other half to Ratledge to identify barriers to economic growth, while Bullock would invest all of the money in existing assets, including the Port of Wilmington, Delaware's workforce, and its corporate-governance-friendly environment. The latter accounts for thousands of jobs and more than a billion dollars in revenue, he said.

A brief debate ensued about the pros and cons of raising taxes, with participants coming down on both sides of the issue.

“Cutting taxes jumpstarts the economy if you have time to let it work,” said Schwartzkopf, “but it's tough to do if you have a mandate to balance the budget every year.”

Wolfe argued, however, that lower business taxes and personal income taxes are more favorable to economic growth. “Small business is the engine that drives Delaware's economy,” he said, “and if you lower income taxes, people have more money to spend.”

Taylor then directed the conversation toward education. “What does government have to do to make our public schools the best in the world?” he asked.

While Rochford proposed that the state should address teacher accountability and develop a plan for handling schools that fail to meet the standards, Levin argued that excess layers of management need to be removed from the educational system.

“This is true of businesses, state government and schools,” he said. “We have too many layers, and they interfere with people getting their jobs done. It's not easy to work with less, but if you respect people and treat them with respect, most of them will rise to the top.”

Harker closed out the session and the conference by saying that he hoped the conversations that had taken place over the two-day event could be translated into action.

“The purpose of these partnership conferences is not just to have a series of nice conversations,” he said, “but to brings ideas to life and make things happen.”

The next event in the Creating Knowledge-Based Partnerships Conference Series will take place at Clayton Hall on Monday, March 22, 2010. It will address “The Future of the Non-Profit Sector.”

Article by Diane Kukich, Ann Manser, Sue Moncure and Jerry Rhodes

Photos by Kathy F. Atkinson, Ambre Alexander and Evan Krape