Grant Management Guide

GRANT DEVELOPMENT

Read the Award

RO procedure is to send tothe Principal Investigator (PI) and Department Administrator (DA) the executed award document. It is expected that the award is read prior to expending funds. This is an important step in maintaining the award. These are some items you should check on: (please note that this is not an exhaustive list)

- Are there special terms or conditions or sponsor requirements?

- Is the award incrementally funded? (e.g., an NIH award subject to SNAP, the Streamlined Non-Competing Award Process)

- Note any deliverables (reports, products)that PI is responsible for.

Budget

Compare the awarded budget to the final proposed budget. Contact the Research Office if there are discrepancies. Note cost-share requirements.

Hint: To check the proposal budget, review in UDataGlance.

Computing Devices

Computing devices means machines used to acquire, store, analyze, process, and publish data and other information electronically, including accessories (or “peripherals”) for printing, transmitting and receiving, or storing electronic information. Charging computing devices as direct costs is allowable for devices that are essential and allocable, but not solely dedicated, to the performance of a Federal award. Reference 2 CFR 200.20 and 2 CRF 200.453.

Award Setup

After receipt of a new sponsored award or continuation from a sponsor, the Research Office will prepare the award for spending. We work with departments and PIs to finalize project budgets, setup backend access and prepare your award to.

Setting up your files at the beginning of an award will help to keep you organized throughout the life of the award and make close-outs and audits a much simpler task. You may find it useful to set up a PROJECT ID folder to track transactions. Subfolders for each budget category or type of transaction allow you to further organize your transaction backup documentation.

When a new purpose is set up by the Research Office for a new project, a copy of the Research Office Chart of Accounts Notification is sent to the PI and department account administrator or department representative (this varies by department). This document is a valuable resource for you to retain to help you in administering your award. The Purpose, Project, Contract, and Proposal IDs are all listed. You will need these IDs to run queries and track your transactions. Validate the accuracy of this report and discuss any discrepancies with the Research Office.

Administrator Directory Search

Cost-Share

Cost-share is defined as funds committed for the project that are not budgeted from grant funds. Some examples include equipment, personnel effort, and tuition. If there are cost-share commitments, contact the departments or colleges that have committed funds. Some cost-share will require companion Purposes; others may be tracked using cost-share Speedtypes or UD Userfields. We will go into more detail on different ways to track cost-share transactions in the section on Maintaining Your Award. The cost share policy can be found here. If the cost-share is from a third party, contact the source and outline requirements for documentation so that you can report these transactions along with the internal cost-share expenses. Specific guidance on cost-sharing in relation to federal grants is in the OMB Circular A-110, Subpart C.23 or UG Subpart D.

Subcontracts Issued by UD

Subcontracts will be coordinated with the Research Office in the following way. Research Office notifies the department to:

- Initiate a purchase requisition for the funds.

- Identify any special reporting requirements requested by the PI.

- Revise the statement of work, budget, and budget justification as applicable.

- Sub-recipient documents, including:

- Subrecipient Commitment Form

- Attachment 3B Subrecipient Contact, Page 1

- Attachment 3B page 2

- Revised Budget, revised budget justification (If needed)

- Revised Statement of Work (if funds were reduced)

- Subs F&A agreement

- Provider Category Determination Worksheet

Department Administrator will establish a seperate file within their main award file to aid in tracking the activity associated with the subcontract . More detail on subcontracts is included in Maintaining Your Award.

Consulting Agreement

A consultant is defined as an individual (not a company) contributing his or her expertise to a research project for a determined fee. The Research Office will send a debarment statement with each contractual agreement. This will allow the Consultant to sign the statement when the Consulting Agreement is signed. Please see UD Policy on Consultants for Research, Public Service or Instructional Activities.

Program Income

Program income means gross income earned by the recipient that is directly generated by a supported activity or earned as a result of the award (see exclusions in Subpart C.24 (e) and (h) of OMB Circular A-110), or UG subpart D during the period of performance.

Program income includes, but is not limited to, income from fees for services performed, the use or rental of real or personal property acquired under federally funded projects, the sale of commodities or items fabricated under an award, license fees and royalties on patents and copyrights, and interest on loans made with award funds.

If there is program income included for award, refer to OMB Circular A-110, Subpart C.24, or UG subpart D for regulations regarding use of program income.

For information on Sponsored Research Program Income Procedures follow this link.

Fabrications

Equipment fabrication is the building of a new stand-alone piece of equipment. If the expectation is that the equipment being fabricated will exceed $5,000 in total cost, this will be budgeted as equipment. If there are fabrications needed as part of the project, transactions should be tracked from the beginning of the award.

Personnel

If personnel are supported on an award, the charges must be coded to appear on the correct project. In addition to direct charges for personnel, there may be related effort commitments which are tracked as cost-share. The Labor Allocation Module (LAM), which you’ll read about next, is a system used at the University of Delaware to allocate both types of personnel effort. Payroll charges are processed by HR and are allocated according to distributions which have been prescribed in the LAM by the employee’s department. Distribution of pay impacts Effort Certification, as well as the direct charges to the grant.

Labor Allocation Module (LAM)

The University of Delaware has a Labor Allocation Module (LAM), whereby administrators can assign accurate funding distribution to each pay per employee. Payroll charges are processed by HR and are distributed according to the prescribed distributions in the LAM. These distributions impact Effort Certification as well as account balances. Both direct charges to grants as well as cost-shared effort are allocated via the LAM. Instructions on how to use the LAM can be found in HR’s LAM procedural manual, and questions about using the LAM may be directed to lam-system@udel.edu. LAM users can log on to use the module here.

Effort Admiministration

Effort Certification is defined as the reporting and confirmation of an employee’s time spent conducting any University activity, expressed as a percentage of the total institutional compensated based time — Institutional Based Salary (IBS). The University of Delaware has an online Effort Certification System. Training documents related to Effort and the Effort Certification System are available here.

Employees must review, and if correct, certify their total effort on all sponsored projects for each effort-reporting period. Effort supporting a sponsored project but not funded by the sponsor is considered cost share. Please see the University’s effort reporting policy and procedures here for detailed explanations and instructions.

UD's research enterprise depends on funding from federal and state agencies, private foundations, organizations, and industry. The University's electronic Effort Certification System is the principal means of verifying that salaries and wages charged to or contributed to a sponsored project are fulfilled in a manner consistent with the award documentation and compliant with the federal regulations for which the University is held accountable.

If you need assistance in identifying your effort administrator, please see the Department Administrator Directory within our Staff Directory. To learn more about administering the effort certification process in your department, check out these training opportunities.

Effort

Effort training is available on the Research Office website here and through ConnectingU. New grant administrators must attend the next available “Introduction to Effort Administration” class. The class is offered throughout the year – at a minimum in March and September. Log-in to ConnectingU for course times and to enroll.

Effort Training Material Effort Online Training Material

Gifts vs. Sponsored Project

There often exists a question over whether funds from a foundation or other non-federal organizations are to be treated as gifts or sponsored projects. The two are very much intertwined. In certain situations, a gift may be administered by the Research Office (RO) or jointly with Development & Alumni Relations (DAR). Ideally these determinations are made at the time of proposal submission; however, at times, the gift or sponsored project determination may not be feasible until funding arrives.

To help identify which UD office (DAR or RO) should administer and process funds, please review and complete the Gifts vs. Sponsored Project Checklist. If you have any questions or are uncertain of the determination, please review with DAR or your assigned C&G Analyst.

Using the NIH Salary Cap Calculator

In order to strengthen compliance with the National Institutes of Health (NIH) Salary Cap, the Research Office has developed a tool to clarify and simplify the salary cap calculation. This tool is intended for use by both department administrators and the Research Office Post Award team to monitor cap compliance during the life of the project and close out at the end of the project. Final determination of salary JVs to move direct salary to cost share in the case of cap overage will be made by the Research Office using the calculator in coordination with the department.

OVERVIEW

The NIH Salary Cap is a federally-mandated limitation placed on the 12-month salary rate that can be directly charged to NIH-sponsored grants

• It is not a limitation on how much a PI can be paid by the university

– It is a limitation on the salary for an individual directly charged to the NIH in proportion to that individual’s institutional base salary (IBS)

• The cap is applicable to subawards and is NOT applicable to consultants

• The cap is calculated on an annual basis, even if salary is charged only in one or two months of the project period

Participant Support Costs

Participant Support Costs (per Uniform Guidance 2 CFR § 200.75) are direct costs for items such as stipends or subsistence allowances, travel allowances, and registration fees paid to or on behalf of participants or trainees (but not employees*). Below are the UD account codes, budget categories, descriptions, and instructions for expensing Participant Support Costs:

- Scope of Work: If Participant Support Costs were not included in the awarded budget a rebudget will be required. The PI must state whether or not adding a participant program to the research grant is a change in the scope (please note this in the comments section of the FIN Budget Revision – Contracts and Grants webform). If there is a change in the scope of work prior agency approval is required.

| Account Code | Budget Category | Description | Applicability | Expense Requests |

|---|---|---|---|---|

| 146115 | PTSTIP | Participant Support Costs: Students | Use this account code when paying UD students participant support stipend and/or a flat amount for travel. | Submit a FIN Request for Payment to Individual for matriculated UD students using dropdown "Participant Support" and account code 146115 and attach documentation related to the award. For students of other institutions please see "non-employees" below. NOTE: 30% will be withheld for foreign payees and IRS Form 1099/1042 will generate as appropriate. |

| 146105 | Participant Support Costs: Travel Reimbursement | Use this account code when reimbursing UD students for travel with receipts. | If payment is for a travel reimbursement, follow the steps above but use account 146105 (include receipts); a 1099 will not be generated. | |

| 146110 | Participant Support Costs: Per Diem Non-resident | This account should be used to pay U.S. General Services Administration (GSA) per diem participant support payments made by the United States Government (either directly or by contract) to a nonresident alien (NRA) individual who is engaged in a program of training in the United States under either the Mutual Security Act of 1954, as amended or Mutual Educational and Cultural Exchange Act of 1961, as amended. Payments under this account will not be subject to federal income withholding tax. In addition, this account may only be used up to the maximum allowable GSA per diem rates. Any amount above or outside the purview of the GSA per diem rates should be charged to 146100 PART SPPRT-NON EMPLOYEE and will be subject to federal income tax withholding and reporting. | ||

| 146100 | PTSUBS | Participant Support Costs: Non-Employees | Use this account code when paying non-UD students or non-employees participant support stipend and/or a flat amount for travel. | Submit a Non-PO Payment Requisition (NPOP) in UD Exchange using commodity code NP-PARTSUP and account code 146100 and attach documentation related to the award. Note: 30% will be withheld for foreign payees and IRS Form 1099/1042 will generate as appropriate. |

| 146105 | Participant Support Costs: Travel Reimbursement | Use this account code when reimbursing non-UD students or non-employees for travel with receipts. | If payment is for a travel reimbursement, follow the steps above but use account 146105 (include receipts); a 1099 will not be generated. | |

| 146110 | Participant Support Costs: Per Diem Non-resident | This account should be used to pay U.S. General Services Administration (GSA) per diem participant support payments made by the United States Government (either directly or by contract) to a nonresident alien (NRA) individual who is engaged in a program of training in the United States under either the Mutual Security Act of 1954, as amended or Mutual Educational and Cultural Exchange Act of 1961, as amended. Payments under this account will not be subject to federal income withholding tax. In addition, this account may only be used up to the maximum allowable GSA per diem rates. Any amount above or outside the purview of the GSA per diem rates should be charged to 146100 PART SPPRT-NON EMPLOYEE and will be subject to federal income tax withholding and reporting. | ||

| 146190 | PTOTHR | Participant Support Costs: Other Vendors | Use this account code when paying a vendor directly on behalf of a participant for non-travel costs. | Submit a Non-PO Payment Requisition (NPOP) in UD Exchange using commodity code NP-PARTSUP and account code 146190 and attach documentation related to the award. NOTE: 30% will be withheld for foreign payees and IRS Form 1099/1042 will generate as appropriate. |

| PTTRAV | Participant Support Costs: Travel Vendors | Use this account code when paying a vendor directly on behalf of a participant for travel costs. | ||

- Budgets: Per Uniform Guidance 2 CFR § 200.407, prior approval of the awarding agency may be required in order to allocate Participant Support Costs to an award. Research Office approval is required to rebudget Participant Support Costs to other categories of expense via the FIN Budget Revision – Contracts and Grants webform. Please contact the Research Office Contract and Grants Analyst with any questions. (Note: NIH does not allow participant support costs on research grants).

- Expenses: Participant Support Costs are expressed as non‐salary expenses and carry no associated facilities and administrative costs on the grant. FIN Request for Payment to Individual, GNCP, or Vendor Webforms are used to allocate appropriate Participant Support Costs to an award.

Who is a participant?

A participant is typically not a UD employee*, and not the provider of a service or training associated with a workshop, conference, seminar, symposium, or other short‐term instructional or information sharing activity.

- Participants are not required to provide any deliverable to UD, and they are not subject to UD Human Resource policies (e.g., they cannot be terminated for failure to perform).

- Participants may include students, scholars, and scientists from other institutions, representatives of private sector companies, teachers, and state or local government agency personnel.

- A person classified as an intern would be paid as an employee and not as a participant, because the intern, while receiving certain training, is also providing services to the university, to the grant sponsor, or to a third party (e.g., counseling students at a local public schools).

*There may be exceptional circumstances wherein participant support costs for UD employees apply; please contact the Research Office regarding these instances.

What costs may be included in participant support costs?

Participant support costs include the direct costs for items such as the following:

- Stipend. A stipend is a set amount of money to be paid directly to a participant. Certain agencies of the federal government specifically restrict participant stipends; the Research Office will assist in determining if these restrictions apply to a specific project.

- Travel. Travel includes the costs of transportation and associated costs. These costs must follow sponsor guidelines (e.g., United States flag carrier, coach class, most direct route) as well as travel rules for UD policies and guidelines. The sole purpose of the travel must be to participate in the project activity (e.g., if a training activity involves field trips, the costs of transportation for participants may be allowable).

- Subsistence Allowance. The cost of a participant’s housing and per diem expenses necessary for the individual to participate in the project are generally allowed, provided these costs are reasonable and limited to the days of attendance. Although they may participate in meals and snacks provided at the meeting or conference, participants who live in the local area are not entitled to subsistence payments.

- Fees. The fees paid by a participant in connection with meetings, conferences, symposia, or training projects are generally allowable costs. These fees may include laboratory fees, passport or visa fees for foreign participants (based on sponsor guidelines), and registration fees. A sponsor may also allow the costs of any UD tuition and fee charges that are required to be paid for the individual to participate in the training project.

- Other. Certain other costs in support of the participant’s involvement may be allowable, including training materials, laboratory supplies, and insurance.

What costs may not be included as participant support costs?

Participant support costs do not include the following types of payments:

- Honoraria paid to a guest speaker or lecturer.

- Conference support costs such as facility rentals, media equipment rentals, or conference food.

- Subaward to a provider for multiple training events (i.e. an ongoing contract with specific terms and conditions).

- Agreements to reimburse an employer (e.g., public school system) for the costs related to sending its employee(s) to a conference or workshop. It is recommended that the PI inform participants prior to the initiation of the project about any costs associated with their participation in the project that are not covered.

- Payments to subjects which should be coded as Participant Compensation.

Web Resources

- 3-rd Party Cost Share Contribution Template

- 90-day Cost Transfer Job Aid

- Automated Closeout Report (ACR) Job Aid

- Automated Closeout Report (ACR) webform login

- Cash Advance Worksheet

- Problematic Charges on Grants

- General Accounting

- Effort Certification System

- Human Resources

- Fly America Act

- Fly America Act Resources

- LAM/Obligations (FIPRD)

- NSF Proposal & Award Policies & Procedures Guide (PAPPG)

- Procurement Services

- Sponsor Terms & Conditions

- UD Financials reporting (FIRPT)

- UD Financials Systems Information

- UD Grants System (FIPRD)

- UD Webforms

- UD Webviews

- UDataGlance

Administrative Salaries

Administrative salaries as direct charges to federal or federal flow through awards Administrative salaries should normally be treated as indirect costs but at times may be appropriate as direct charges if certain conditions are met (2 CFR 200.413):

- Integral to a project or activity

- Individual(s) involved can be specifically identified with the project or activity

- Costs are included in proposal budget and awarded by sponsor or have prior written approval from sponsor

- Costs are not also recovered as indirect costs

Salaries that are determined to be administrative and meet the criteria above must included in the budget and justification at the time of proposal. The budget justification template in the UD Proposal Development guide (see Budgets & Rates) provides template language for these costs. They must also be budgeted accordingly in the UD financial system. For professional administrative staff, the budget category to use in the PeopleSoft (PS) proposal is OSPRER and for salaried administrative staff the budget category to use in PS is CLERK.

For professional administrative staff, the budget PS account to use is 120200. The individual should be paid from the appropriate salary expense PS account. For salaried administrative staff, the budget PS account to use is 123000 with the appropriate salary expense PS account used for expenses.

| Budget Category | Budget PS Account | Expense PS Account |

|---|---|---|

| CLERK | 123000 | 123XXX |

| OSRPER | 120200 | 120XXX |

If administrative salaries were not included in proposal submission and funds awarded by the sponsor, you may need prior approval from the federal or federal flow through sponsor before you allocate administrative salary expenditures to the award.

Revisions to sponsored project budgets that require sponsor prior approval must be reviewed and approved by the Research Office. Once approval is received from the sponsor, if the budget revision is to be done within one project a FIN Budget Revision – Contracts and Grants webform should be processed by the department. This will rebudget the funds into the correct budget PS accounts. If the budget revision is to be done between sponsored projects on the same award, the process will be managed by the Research Office.

Billing

Billing to sponsors and cash received from sponsors is handled by the Research Office. Cash and Billing transactions can be viewed in the Financials queries. It is important to note that cash received prior to the Grants and Billing modules going live in July 2004 is reflected differently than cash that has been received after 7/1/2004. To view all cash received for a Project, it may be necessary to run all three cash queries to get a total.

GMQ_CASH_NOT_PS_BILL Cash received outside of PS Billing — This query gives all Cash received outside of the Billing module.

GMQ_CASH_PS_BILLED Sum of PS billing activity — This query gives you all Cash received as a result of a Billing in PS module.

GMQ_CASH_THRU_2002 Total Cash as of 7/1/02 — This query gives you a total of all cash received prior to 7/1/02 (prior to Financials go-live date).

Budget Revisions

During the conduct of the project, the principal investigator may determine that budget changes are necessary. Many sponsors allow flexibility in how project funds are expended and permit budget changes needed to meet project requirements. Principal investigators need to be aware of the specific requirements for their awards and to request prior approval for budget changes when necessary.

For further information, please review Budget Revision procedure for Sponsored Awards.

Capitalizing Fabrications

Equipment fabrication expenses should be allocated to PS account 153100, which does not incur F and A costs. If more than one piece of equipment is being fabricated on a particular PS purpose, or if a piece of equipment is being charged to multiple purposes, it is best to track the expenses as they occur so that you can identify the individual charges for a particular fabrication. Keeping an updated spreadsheet or tagging transactions in UD AT A Glance are good tracking methods.

When a fabrication is complete, all charges must be transferred by a journal voucher process from PS account 153100 to 167900 for capital equipment by completing the UD Equipment Activity web form. The capitalization Journal Voucher (JV) may only be processed by General Accounting, following all approvals on UD Equipment Activity web form. Equipment must have an initial value of at least $5K. After capitalization, cost adjustments (also done via JV) will only be allowed by General Accounting if the added value is at least $2K. See University Policy 5-10 in the Procurement and Auxiliary Services section for more details on what qualifies as capital equipment.

All the charges to be included in the capitalization must be transferred from PS account 153100 to 167900.

Cost Accounting Standards (CAS)

When a sponsor awards funds to the University in support of specific programs and projects, it requires the University to manage those funds prudently to ensure that any costs incurred directly benefit the project accounts being charged.

The Federal Government is the largest sponsor of externally funded activity at the University. The cost principles relating to expenditures on federal awards are contained in the Office of Management and Budgets (OMB) Circular A-21 “The Cost Principles for Institutions of Higher Education” and Uniform Guidance 2 CFR 200. These cost principles require that any expense charged to a federally sponsored project be reasonable and necessary, allocable, consistently treated, and conform to any limits or exclusions set forth in A-21, Uniform Guidance (UG), or the terms and conditions of the award.

Anyone approving or processing the expenditure of federal funds must have a clear understanding of Cost Accounting Standards (CAS)and apply consistent application of these fundamental cost principles. In addition, individual awards may include special terms and conditions which must be considered when incurring costs. Terms and Conditions in an award which specifically address costs override all related comments in the CAS guidelines document. Consult with the appropriate Contract and Grant Administrator in the Research Office for more details.

Cost Allocations

PIs and their Department/College Administrators are responsible for allocating costs to their grants in a timely and compliant manner. The Direct Charging Procedure outlines cost principles and UD standards for allocating expenditures to sponsored research programs. This includes instructions and examples for split cost allocations.

Equipment Cost-Share

There are several types of cost-share that can be part of an award. The type of cost-share determines how it is tracked. Effort cost-share will be discussed later in this section under “Reconciling Transactions.” The cost share policy can be found here: Cost Share Policy

Research Office Equipment Cost-Share — A separate Purpose is established to track this type of cost-share. All transactions using these Purposes should automatically be populated with the ProjectID. However, it is possible that some transactions may appear in Financials without the Project ID. If this should happen, it is important to contact the responsible department to correct the transaction (i.e., if a Purchase requisition, contact Procurement, JV-initiating department) or the expense will not be reflected as cost- share related to the grant.

Other Equipment Cost-Share — Match funds from UD sources other than Research Office may not have a separate Purpose established. There are several different ways to track these transactions.

Populate the Project ID in the Project ID field when a transaction is initiated. For example, in a purchase requisition, you would fill in this information at the time the Requisition is submitted. If you are using your departmental supplemental funds Purpose (such as CHEM17S000), the Project ID field is normally blank. By filling in the Project ID, you can run queries to pull all cost-share transactions together, regardless of funding source.

Useful queries for tracking cost-share are:

GMQ_CS_COMMITTED_EXPENDED_V — Shows cost-share (match) committed and spent amounts by project.

GMQ_PO_W_CS_BY_PROJECT — Returns PO data by Project ID and PO and cost-share (details).

Cost-share must be verifiable or it may be disallowed. If the department is not able to document that the committed cost-share was provided, a percentage of the awarded funds may be returned to the sponsoring agency.

More information about Equipment Cost Share

Cost Transfer (Journal Vouchers)

A cost transfer is any adjustment or transfer of expenditures to/from an externally funded contract or grant purpose/project by means of a journal voucher. Diligent review of financial records and timely communication between principal investigators and departmental administrators should prevent the necessity for transfers; however, under certain circumstances transfers may be appropriate.

To comply with the requirements of OMB Circular A-21, and Uniform Guidance 2CFR 200, and the requirements of other federal sponsors, University of Delaware has established the following procedures for the processing of cost transfer.

DHHS Salary Cap

DHHS restricts the amount of direct salary of an individual under an NIH grant or cooperative agreement or applicable contract to Executive Level II of the Federal Executive Pay scale. Please see the salary cap summary and the time frames associated with existing salary caps at https://grants.nih.gov/grants/policy/salcap_summary.htm. An individual’s base salary, per se, is NOT constrained by the legislative provision for a limitation of salary. The rate limitation only limits the amount that may be awarded and charged to NIH grants and contracts. An institution must pay an individual’s salary amount in excess of the salary cap with non-sponsored funds. The amount of funding above the salary cap must be coded as cost-share in order to demonstrate compliance with the cap.

The Summer DHHS Salary Cap and DHHS Salary Cap pay guidance is now available relating to summer pay on NIH grants for faculty members on academic year contracts has been released by the Research Administration Team regarding supplemental compensation. Additionally, guidance regarding salaries for employees whose Institutional Base Salary (IBS) exceeds the DHHS salary cap is also available in this guidance with recommended procedures. Please click below to download this DHHS guidance document or visit our website to learn more.

Effort Admiministration

Effort Certification is defined as the reporting and confirmation of an employee’s time spent conducting any University activity, expressed as a percentage of the total institutional compensated based time — Institutional Based Salary (IBS). The University of Delaware has an online Effort Certification System. Training documents related to Effort and the Effort Certification System are available here.

Employees must review, and if correct, certify their total effort on all sponsored projects for each effort-reporting period. Effort supporting a sponsored project but not funded by the sponsor is considered cost share. Please see the University’s effort reporting policy and procedures here for detailed explanations and instructions.

UD's research enterprise depends on funding from federal and state agencies, private foundations, organizations, and industry. The University's electronic Effort Certification System is the principal means of verifying that salaries and wages charged to or contributed to a sponsored project are fulfilled in a manner consistent with the award documentation and compliant with the federal regulations for which the University is held accountable.

If you need assistance in identifying your effort administrator, please see the Department Administrator Directory within our Staff Directory. To learn more about administering the effort certification process in your department, check out these training opportunities.

Effort

Effort training is available on the Research Office website here and through ConnectingU. New grant administrators must attend the next available “Introduction to Effort Administration” class. The class is offered throughout the year – at a minimum in March and September. Log-in to ConnectingU for course times and to enroll.

Effort Training Material Effort Online Training Material

Grant Transfer Procedure

When a Principal Investigator (PI) of an externally-funded grant changes institutions, a decision is made about whether the grant stays at the current institution or is transferred to the new institution. UD will determine on a case-by-case basis whether it will retain or transfer a grant. Because the grant award is made to the institution and not to the PI, there must be agreement between the institutions and the sponsor as to where the grant will ultimately reside.

Meals (non-travel)

Please refer to the University of Delaware’s policy Reimbursement for Faculty, Professional, and Staff. Entertainment of University Guests here for information on the criteria for the reimbursement of payment of expenses for entertainment.

Meal expenses (non‐travel) are the responsibility of the individuals and are rarely allowed on grants and contracts. This includes meal costs incurred for ad‐hoc meetings, working lunches, lab coffee breaks, routine operations, staff meals, recurring weekly/monthly meeting to discuss the progress on an award, meetings to discuss research during lunch or dinner, or otherwise any intramural meetings of an organization or any of its components, including, but not limited to, laboratories, departments and centers.

Furthermore, meal expenses related to “amusement, diversion, and social activities and any costs directly associated with such costs (such as tickets to shows or sports events, meals, lodging, rentals, transportation, and gratuities) are unallowable” on sponsored awards (OMB Circular A‐21, section J‐17). Meals (non‐travel) may be directly charged on a grant/contract if it is part of a formal meeting or conference where technical information, directly related to the award, is being disseminated. (OMB Circular A‐21, section J‐32). In such cases:

- Document the purpose of the meeting

- Retain a copy of the formal agenda

- Retain a list of attendees, both internal and external

- If know in advance, include the cost in the proposal with justification for approval by the awarding agency.

It is also permissible to charge the “reasonable” costs of the meals of a visiting researcher to the award, if the purpose of the visit is collaboration on the specific grant/contract; the associated meal expenses for the UD PI is unallowable on the award but may be charged to the departmental general funds or discretionary accounts.

Note that sponsors may place more stringent restrictions than specified in this procedure; refer to the terms and conditions outlined in the notice of award for requirements and/or treatment of such costs.

Monitoring Expenditures

Reconciling transactions on a monthly basis is important to grants management. As with other aspects of grants management, several methods can be used to reconcile your transactions.

UD at a Glance

This application allows University personnel to view University financial data for which they are authorized. The UDataGlance tool may be used for daily review of budget and expenditures and should be used for monthly reconciliation of purpose codes via the monthly statement view. You may access UDataGlance here.

Statements

Web-enabled statements are provided by General Accounting. This report provides the user with a view of summed and detailed transactions and balances for Purposes/Projects which they are permitted to view. You may access instructions via UDataGlance here.

Queries

Useful Queries for reconciling transactions are:

GMQ_PI_GRANT_BALS

GMQ_PI_GRANT_BALS_BY_ACCT

GMQ_PI_GRANT_BALS_CATEGORY

GMQ_TRANSACTIONS

EZQ_TRANS_NONBUDGETQUERY — Non Budget Transactions

EZQ_TRANS_NONBUDGETACCT — Non Budget Transactions- for a specific Account

EZQ_TRANS_NONBUDGETPURP — Non Budget Transactions- for a specific Purpose

EZQ_TRANS_BUDGET_QUERY — Budget Only Transactions

Checking Balances

Running a query in UD Financials is another method for checking a balance on an award. You can find a list of some pre-written grants queries and their uses here.

GMQ — Maintained by the Research Office; provides Proposal, Project, and CASH information

Samples include:

GMQ_PI_GRANT_BALS

GMQ_PI_GRANT_BALS_BY_ACCT

GMQ_PI_GRANT_BALS_CATEGORY

GMQ_TRANSACTIONS

Here are some specific balance queries for project to date purposes:

EZQ_BAL_PROJ_QUERY — Project-to-date balance summarized by account

EZQ_BAL_PROJ_SUMMARY — Project-to-date balance summarized by acct category

EZQ_BAL_PROJ_TOTAL — Project-to-date balance: one line “bottom line” amount

Cost Transfers and Corrections

Cost transfers should be completed within 90 days of the original charge. Journal Voucher instructions and rules are listed on the General Accounting Web page.

Note: Refer to the UD Policy on Cost Transfer for details on the University’s procedure on cost transfers related to sponsored research projects.

No-Cost Extensions

NO-COST EXTENSION REQUESTS

While sponsors expect Principal Investigators (PI) to complete projects by the stipulated end date, occasionally extra time is needed. A no-cost extension (NCE) gives the PI extra time to complete the original scope and objectives of the project without additional funds being provided by the sponsor. Although requests may not be made for the sole purpose of spending remaining funds, you may expend remaining funds during the NCE period if approved. In the event your request is not approved, costs incurred after the end date are unallowable and should be removed from the award.

The following should be considered when requesting a NCE:

- Additional time beyond the established expiration date is required to ensure adequate completion of the originally approved project.

- Continuity of grant support is required while a competing continuation application is under review.

- The extension is necessary to permit an orderly phase out of a project that will not receive continued support.

The Research Office recommends a review of your award at least 90 days prior to the end date to assess if a NCE may be required to complete the project objectives. PIs and/or Department Administrators should complete the NCE Checklist and send it their assigned Contract and Grants Specialist. The Contract & Grants Specialist will submit the request to the sponsor.

NOTE: Each sponsor requests unique information. Refer to the award document and sponsor specific guidelines for NCE requirements.

NSF Two-Month Rule Policy

As a general policy, NSF limits the salary compensation requested in the proposal budget for senior personnel to no more than two months of their regular salary in any one year. It is the organization’s responsibility to define and consistently apply the term “year”, and to specify this definition in the budget justification. This limit includes salary compensation received from all NSF-funded grants. This effort must be documented in accordance with 2 CFR § 200, Subpart E, including 2 CFR § 200.430(i). If anticipated, any compensation for such personnel in excess of two months must be disclosed in the proposal budget, justified in the budget justification, and must be specifically approved by NSF in the award notice budget.

Under normal budgeting authority, a grantee can internally approve an increase or decrease in person months devoted to the project after an award is made, even if doing so results in salary support for senior personnel exceeding the two-month salary policy. No prior approval from NSF is necessary unless the re-budgeting would case the objectives or scope of the project to change.

University Post-Award Guidance

By this policy, NSF intends to limit the amount of funds institutions request from NSF, and therefore the amount NSF will award. Departments should review the proposal budget, budget justification, and award notice to confirm if compensation in excess of two months was already approved within the NSF award. If not already approved and additional effort in excess of two months is required to successfully address the research aspects of the proposed project, submit a re-budget request for internal approval. NSF prior approval is necessary if the objectives or scope of the project change.

Although the NSF two-month rule identifies the salary limit as applicable to “any one year”, for award expenditures UD has defined the year as September – August. Departments should routinely reconcile budget versus expenses, and conduct an annual fiscal review of salary expenditures for the one year period (September – August). Lack of approval and appropriate justification can lead to removal of the salary in excess of two months.

Reference: NSF Proposal & Award Policies & Procedures Guide (PAPPG).

Record Retention

The managers of each University area, unit, department or administrative entity must address the following record-keeping issues inclusive of any and all media on which records and information are stored. Managers have responsibilities to:

- Establish and document departmental standards for records classification and file organization to ensure effective retrieval mechanisms for departmental information and records;

- Establish and document measures for protecting sensitive or critical departmental information and records from disclosure;

- Establish and document procedures that ensure departmental records and information are protected from disaster (See Planning to Assure Business Continuance in the Event of a Disaster);

- Develop documentation for department specific systems, such as data bases, spreadsheets or any customized application, to insure continuity of departmental operation;

- Comply with the University’s Records Retention Program.

NOTE: Departmental compliance with this policy will be monitored through the Records Retention Program.

Please see the full UD policy for Record Retention here. Requirements specific to sponsored programs is available here.

Reporting

Throughout the life of the award, scientific and technical reporting is the responsibility of the PI. Most financial reports required by the sponsor will be prepared and signed by Research Office as the authorized official of the University of Delaware.

Residual Balance Transfer

The Residual Balance policy sets forth the final disposition of residual balances on Fixed-Price, Fixed-Rate, and Non-Refundable grants and contracts at the University of Delaware (UD) in which no designation was made by the sponsor as to the use of any unexpended balance.

This policy sets forth the requirements for justification, approval, and management of unexpended balances for Fixed-Price, Fixed-Rate or Non-Refundable contracts. If assurances and justifications are provided per this policy, an unexpended balance may be transferred to the appropriate residual account defined by the administering department.

Residual balances will be distributed proportionately between direct costs and F&A costs, with the direct cost amount being transferred to the administering department. The F&A costs will be transferred to the Central F&A pool.

All residual balance requests require a Residual Balance Transfer form be completed and submitted to the Research Office for processing.

Subcontracts

The Subaward Management Policy outlines PI, unit, and Research Office responsibilities and processes for managing outgoing subawards execution, amendment, monitoring, and closeout. If there is a subcontract, you will receive invoices from the subcontractor via the Research Office. The PI and the account administrator should review and approve the invoices. It is important for the PI to review and approve each invoice as confirmation that the subcontractor is performing work as indicated in the Scope of Work. GMQ_PO_ACTIVITY_SUM query is available to view what has been committed and expended for purchase orders by PS Account. If there are additional funds for the award in subsequent budget years, the subcontract purchase order must be increased to reflect the additional funds. Payment of the final invoice on any subcontract is contingent upon receipt of the closeout reports required in the subcontract agreement. Instructions for the use of the Purchase Order Amendment Web Form to process an amendment to a subaward may be found here >>

Service / Maintenance Contracts for Equipment

Service/maintenance contracts on sponsored projects are agreements with a vendor to perform services to ensure the equipment’s satisfactory operation during the life of a sponsored project. There are two types of payment options for service/maintenance contracts: advance payment or a payment schedule. This guidance addresses advance payments for equipment contracts.

UDX and Concur Guidance on Sponsored Programs

Procurement Services and the Research Office together offer the following guidance regarding the use of UD Exchange and/or Concur with respect to sponsored programs (sponsored direct, cost share, program income), particularly as it relates to documentation of award costs. While this may apply to all UD purchases, UD staff involved with post-award activities should directly benefit from this guidance.

Unallowable Costs

Unallowable costs are defined as those expenses which are not reimbursable under the terms and conditions of federally sponsored agreements and/or those specifically identified as unallowable in Section J of OMB Circular A-21 (2 CFR Part 220), and Uniform Guidance (UG) Subpart E In the event a discrepancy exists between the provisions of OMB Circular A-21 and UG and those specified within the sponsored agreement, the agreement provisions will prevail.

An expense must meet all of the following criteria to be considered an allowable cost:

- The cost is reasonable: A prudent person would have purchased this item and paid this price.

- The cost is necessary: The expense is required to fulfill the terms and needs of the sponsored agreement.

- The cost is allocable: The expense benefits the sponsored agreement or, when the expense benefits more than one activity, an appropriate share can be allocated to individual agreements.

- The cost is consistently treated: Expenses for the same purpose are treated and classified the same way under like circumstances.

- The cost is not prohibited: The expense is not specifically prohibited by OMB Circular A-21 and Uniform Guidance (UG), the terms of the sponsored agreement or other regulations.

If an activity/expense does not meet the above criteria, it cannot be charged directly to a federal award nor can it be included in the indirect cost base regardless of its purpose. In addition, it cannot be used to meet a cost share commitment.

Unallowable costs are identified and segregated by a combination of the following methods:

- Separate PS account code

- Review of expenses conducted as part of a monthly reconciliation of expenditures by Research Administrator (GMQ_TRANS_UNALLOWABLE)

- Review of expenses conducted by Research Office personnel during closeout

Useful Tools

UD at a Glance

This application allows University personnel to view University financial data for which they are authorized. This tool may be used for daily review of budget and expenditures and should be used for monthly reconciliation of purpose codes via the monthly statement view. You may access UDataGlance here.

QUERIES

The PeopleSoft Query tool allows you to extract financial data. The Query tool can be used to do the following:

- Preview query data within Query Manager and Query Viewer, displaying the results set in a table format;

- Write new or modify existing queries (be sure to *SAVE AS* rather

than overwrite the original query) to extract new data sets; and - Download query results to an Excel spreadsheet.

Query training introduces you to some of the basic functions of the PeopleSoft (PS) Query tool as they are used at the University of Delaware. Many pre-written queries also are available for use. A PowerPoint presentation explaining Grants Reporting is available here. Also included is a list of public, pre-written queries. Public queries may be added or deleted, so check in Query Viewer or Query Manager to see an updated list. Several acronyms have been designated for pre-written queries. Here are a few:

GMQ — Maintained by the Research Office; provides Proposal, Project, and CASH information.

Samples include:

GMQ_PI_GRANT _BALS

GMQ_PI_GRANT_BALS_BY_ACCT

GMQ_PI_GRANT_BALS_CATEGORY

GMQ_TRANSACTIONS

GMQ_SUB_INVOICE_ACTIONS

EZQ_BAL_PROJ queries — Maintained by General Accounting; provides Balances and Transaction information for a specific project to date purpose, not by specific project ID.

PIQ — Maintained by Research Office; provides curriculum vitae information from the Employee Demographic Data (EDD), as well as F and A by PI.

UDQ — Maintained by the Treasurer’s Office; various useful types of information dealing with Purpose details such as Authorized signers, Titles, Speedtypes, etc.

OBQ — Maintained by the Budget Office; provides information related to Obligations.

Automated Closeout Report (ACR) Job Aid

DISCLAIMER: This Job Aid is not meant to be an “all-inclusive” list. The Job Aid has been prepared to help guide users in reviewing, preparing, and completing all the sections of the automated closeout report. The Sponsored Research Accountant (SRA) will utilize this information during their financial reconciliation and follow-up with the Department/College Administrator to process any pending items.

If you have questions or need additional help, please contact the Research Office SRA.

| Why it is Important: |

|

Closeout Timelines and Escalation: | The table below summarizes key closeout dates and communications per the applicable closeout period: |

| No-Cost Extension |

|

| Technical Report: |

|

| Equipment Inventory: |

|

| Potential Inventions: |

|

| Cost Share: |

|

| After End-Date: |

|

| Potential Unallowable Charges: |

|

| Purchase Orders: |

|

| Confirm Final Expenditures: |

|

| Routing and Authorization: |

|

Automated Closeout Report (ACR) Webform

This is a webform to manage project status and prepare for Closeout.

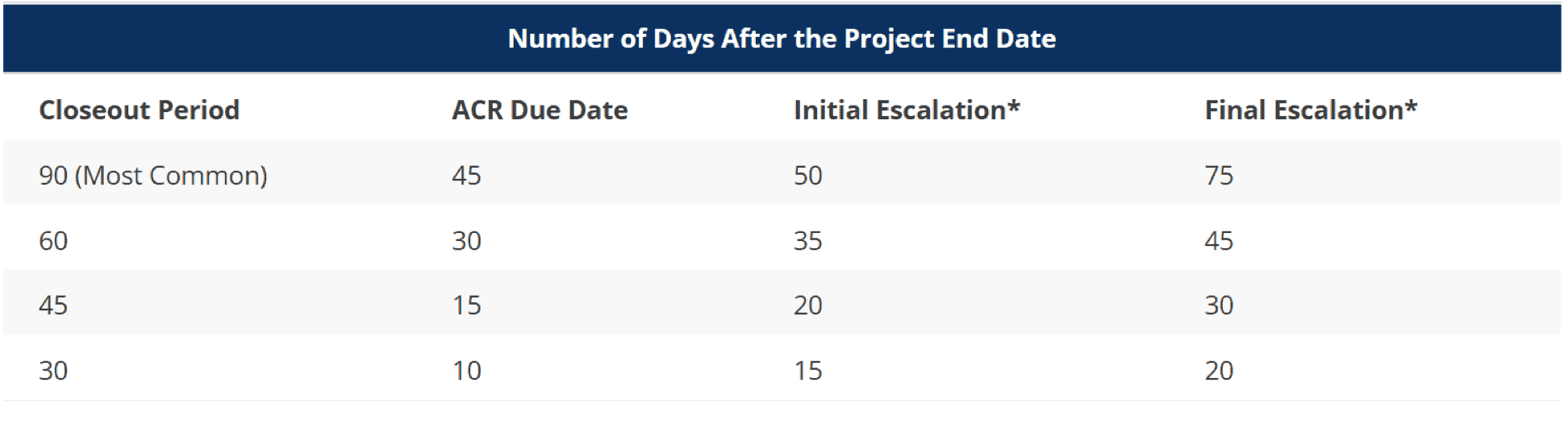

Closeout Timelines and Escalation

The closeout period depends on the final invoice/report submission deadline set forth via sponsor/award terms and conditions. For most awards, a 90-day closeout period is applicable, as this is the standard per OMB Uniform Guidance.

The ACR should be returned to the Sponsored Research Accountant by the ACR Due Date. All sections should be reviewed and completed, including applicable comments from the Department/College Administrator. The Sponsored Research Accountant will utilize this information during their financial reconciliation and follow-up with the Department/College Administrator to process any pending items.

The table below summarizes key closeout dates and communications per the applicable closeout period:

| Closeout Period | ACR Due Date | Initial Escalation* | Final Escalation* |

| 90 (Most Common) | 45 | 50 | 75 |

| 60 | 30 | 35 | 45 |

| 45 | 15 | 20 | 30 |

| 30 | 10 | 15 | 20 |

Web Resources

- 3-rd Party Cost Share Contribution Template

- 90-day Cost Transfer Job Aid

- Automated Closeout Report (ACR) Job Aid

- Automated Closeout Report (ACR) webform login

- Cash Advance Worksheet

- Problematic Charges on Grants

- General Accounting

- Effort Certification System

- Human Resources

- LAM/Obligations (FIPRD)

- Procurement Services

- UD Financials reporting (FIRPT)

- UD Financials Systems Information

- UD Grants System (FIPRD)

- UD Webforms

- UD Webviews

- UDataGlance

- Department of Defense

- Education Department General Administrative Regulations (EDGAR)

- Fly America Act Definition

- Fly America Act

- NASA Grant and Cooperative Agreement Handbook

- Naval Research Laboratory

- NIH Grants Policy Statement

- NSF Proposal and Awards Policies & Procedures Guide