Young investors

Delaware students recognized for winning Stock Market Game

12:24 p.m., Feb. 12, 2014--To be successful in the stock market, it might be wise to take advice from a 9-year-old.

Or at least, talk to Jacob Curlett and Braxton Wood. The pair of fourth graders, along with teammates Jared Blackburn and Jalen Manson from Newark’s Leasure Elementary School, used an imaginary $100,000 and “invested” in real stocks in real time, growing their portfolio by nearly 25 percent over 10 weeks to $124,300.

Honors Stories

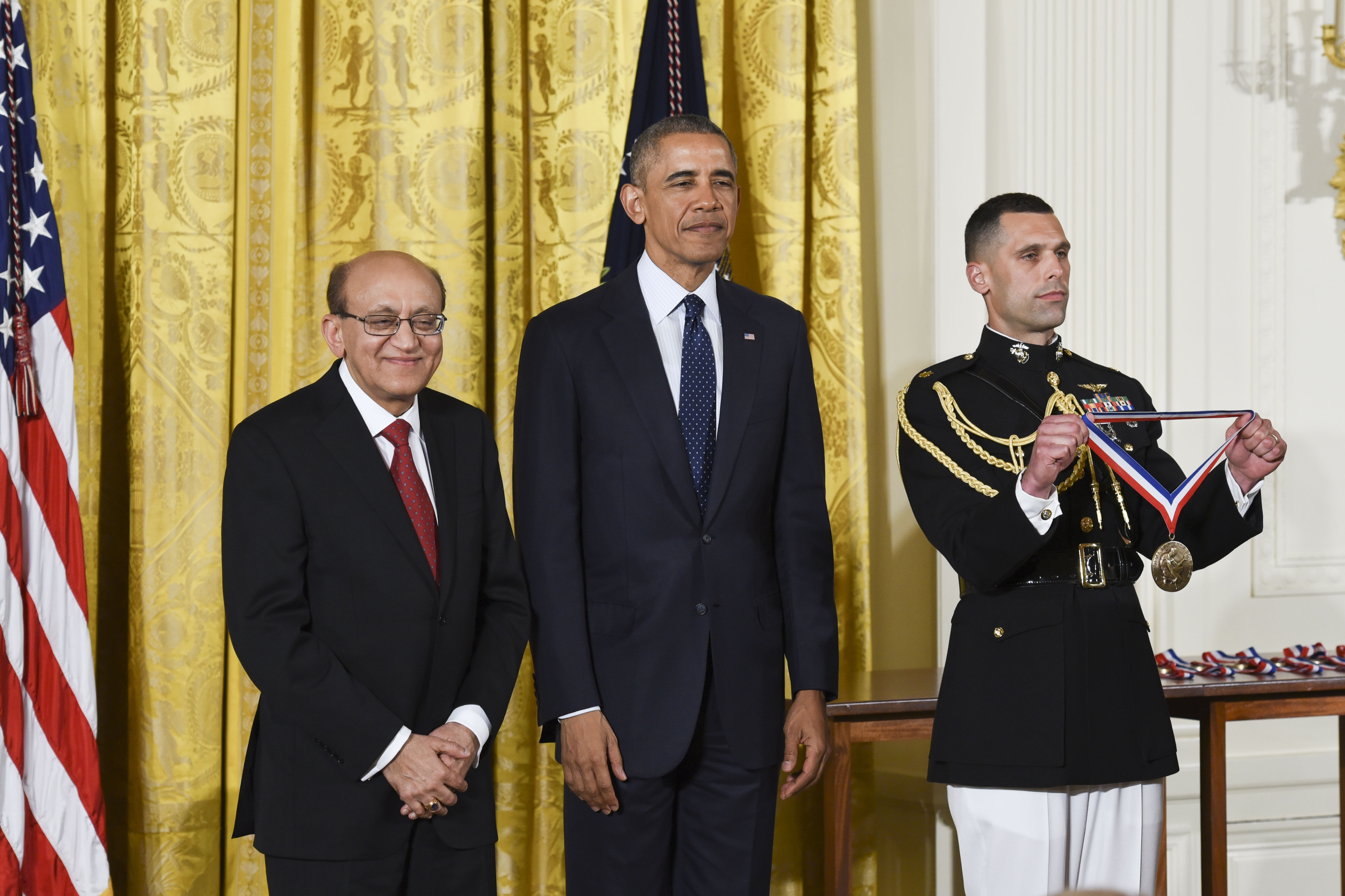

National Medal of Science

Warren Award

The boys were among 650 Delaware students who participated in the Stock Market Game offered through the University of Delaware's Center for Economic Education and Entrepreneurship (CEEE) from Oct. 7 through Dec. 13, 2013.

Last Thursday, they and other grade-level winners were recognized at a reception at the Perkins Student Center.

"I thought Braxton and I could get real money," Curlett said with a smile.

There was no real money at stake for the boys, or the other students who played, but there was plenty to learn.

"We used a lot of diversification and we bought Google," said Sabrina Bey, a high school student from Red Lion Christian Academy, who won in her division with teammates Justin Hazewski and Elizabeth Swierczek with a closing portfolio value of $125,600. “That made us profitable.”

The Stock Market Game is administered by the Securities Industry and Financial Markets Administration and has been offered in Delaware exclusively through CEEE since 1983.

To play, teams of fourth through 12th grade students invest a hypothetical $100,000 in publicly traded stock listed on the New York and Nasdaq exchanges.

They choose their trades, at real-time prices, entering them on the Stock Market Game website. Over the course of 10 weeks, they monitor the value of their portfolios and their overall rankings. The teams with the most portfolio growth in each grade-level category are declared winners.

While learning valuable lessons about percent losses and gains, investments and equities, the students researched company performance and studied how politics, economics and even weather impact stock prices.

As the students from local elementary, middle and high schools and Boys and Girls Clubs were recognized with trophies and certificates Thursday, they were also called upon to reflect on what they'd learned.

"Our strategy was to keep the good things and sell the bad things," said 13-year-old Jonathan Dynan. He and his partner, 12-year-old Logan Humphrey, competed with the Boys and Girls Clubs Middle School Division and grew their portfolio to $125,300.

Also in the middle school division, Will Beardwood, Kyle Cunningham, Bryce Gordy and Matt McCuster from the Pilot School took first place. The team, which realized the highest return of all winning teams at more than 35 percent, grew their portfolio to $135,200.

Bri’Yahna Rush, 12, and Shanasia Nix, 11, along with teammate Sharese Johnson, bought stock in companies they figured would see profits over the holiday season, like Nike, Amazon and Foot Locker to win the Greater Newark Boys and Girls Club elementary division with a final portfolio value of $117,000.

“We bought stock in Foot Locker and sold it at the end of Black Friday,” said Nix, who learned about the concept of exchanges by playing.

Despite her experience -- she and teammates also saw a nearly 20 percent profit gain -- Nix said she isn’t eager to invest in the stock market.

“What if they start to go down?” she asked. “What if you sell lower than what you gave for it?”

Hazewski also felt stock investments were too risky.

But their participation taught them lessons that transcend the game and aren’t limited to just the stock market.

“You will be careful in all your investments, whether in the stock market or otherwise,” Owen Lefkon, director of the Investor Protection Unit of the Delaware Department of Justice, told the students at Perkins.

Carlos Asarta, director of the center and an associate professor of economics in UD’s Alfred Lerner College of Business and Economics, thanked the Delaware Department of Justice and Lefkon for their continuous support of the Stock Market Game. He also congratulated the students for their impressive results and thanked the teachers and parents for caring and supporting the students.

In addition to buying and managing their trades, each student was also encouraged to participate in InvestWrite, a national writing competition that allows students to showcase their overall understanding of the role of the stock market in the American economy and their ability to write critically about investment strategies.

Madelyn Degnars, 10, from Wilson Elementary School, explained in her winning essay how the stock market works. In addition to her research for the game, she also learned a valuable lesson or two just by playing.

“I picked up stuff I saw on Nasdaq,” she said.

Article by Kelly April Tyrrell

Photos by Evan Krape