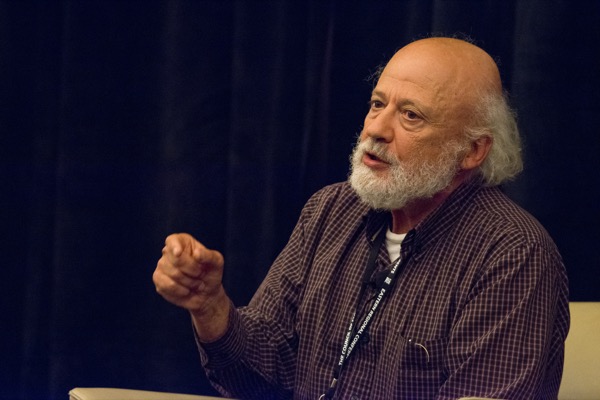

Minimum wage panel

Discussing the minimum wage with state legislators, experts, business leaders

10:17 a.m., Sept. 3, 2015--Debate on minimum wage laws has taken center stage, underscoring the fact that much of the power to mandate wages currently rests in the hands of state governments. In 2015, 29 states have set their minimum wage above the federal level of $7.25.

This summer, Dean Bruce Weber of the University of Delaware’s Alfred Lerner College of Business and Economics moderated a panel discussion on the minimum wage before an audience of state and government leaders as part of the annual meeting of the Regional Policy Forum.

People Stories

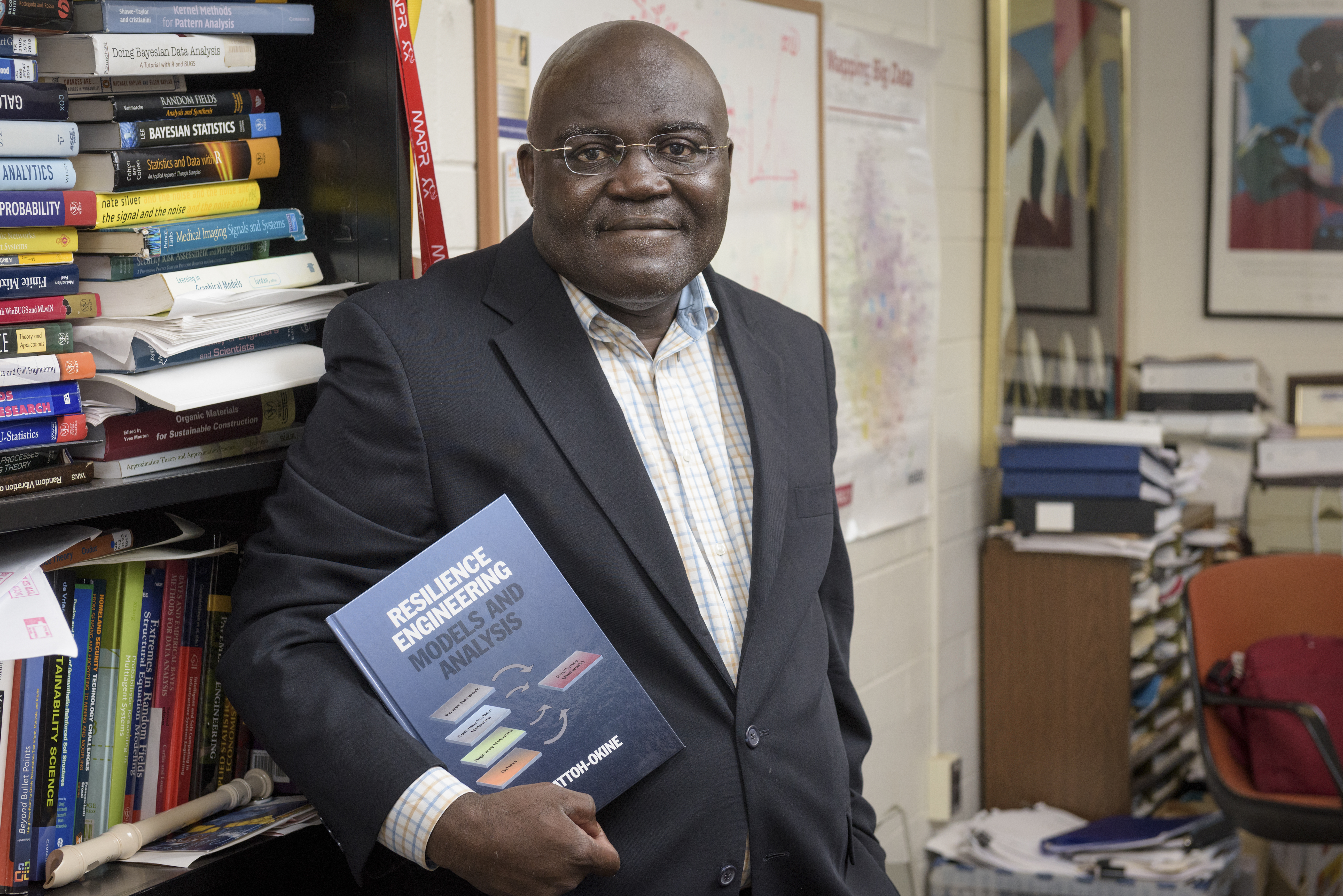

'Resilience Engineering'

Reviresco June run

The forum, held in Wilmington by the Council of State Governments (CSG) Eastern Regional Conference (ERC), is the largest regional gathering of state and provincial government leaders in the East, serving 11 northeastern states from Maine to Maryland as well as Puerto Rico, the U.S. Virgin Islands and the eastern Canadian provinces.

The panel, designed to help inform policy and promote discussion on both sides of the debate, featured four thought leaders including:

- Jeff Furman, chairman of the board at Ben & Jerry's Ice Cream;

- Anthony Wedo, who served as CEO and president of Ovation Brands;

- Gabe Morgan, vice president and 32BJ PA/DE state director for the Service Employees International Union; and

- Michael R. Strain, deputy director of economic policy studies at the American Enterprise Institute.

Strain acknowledged the importance of the panel’s policymaking audience, saying, “The national media spends a lot of time paying attention to Washington and the presidential races, but the people in this room do a whole lot of the governing that actually affects people’s day-to-day lives.”

Weber began the panel discussion with a brief history of the minimum wage since its inception in 1938, and asked each of the panelists to share their thoughts on the effect of an increased minimum wage.

Ben & Jerry’s CEO Furman opened with a description of the company’s business model, which includes paying workers more than $16 per hour plus benefits. He said that while wage decisions are driven by the company’s essential social mission, this hasn’t stopped Ben & Jerry’s from increasing employment and growing consistently.

“The principles for me are that everybody is entitled to a living wage if they’re working 40 hours a week,” Furman said. “That’s a basic right that they should have as the minimum wage was originally conceived.”

For this reason, Furman urged state legislatures to begin to raise the minimum wage over several years with the target of achieving a living wage in a short, reasonable amount of time.

“That really is our responsibility,” he said, explaining that Ben & Jerry’s uses its entire supply chain to solve economic problems. An example of this can be seen in one of the company’s bakeries, which only employs workers who have been previously incarcerated.

Strain countered with the argument that Ben & Jerry’s is successful precisely because they make wage decisions that suit their company instead of decisions that are complying with a government mandate.

“They’re able to find what works for them and to operationalize what they do in a way that makes sense,” Strain said. Instead of forcing other companies to adopt the same model, he continued, the answer is to focus on growth and job creation.

“Does raising the cost of hiring a less skilled worker make sense if the goal is to get more workers employed? I think the answer is clearly no,” he said. “It makes sense to err on the side of caution.”

Wedo agreed, saying, “There is no other solution to where we are now other than growth. We have to begin to strip away some of those inhibitors that drive the incentive out of the business community.”

He noted that incentive is important both for business owners and for workers, adding that only a small percentage of his company’s employees are paid minimum wage, but that wage raises are based on performance.

“You remove all of the incentive if you force even the entry-level person to be at $15 an hour,” he said.

Furman then asked why this same logic is seemingly applied only to low-wage workers.

“By paying them $15 an hour, why are we saying they’ll stop trying to improve their lives and economic performances, but we don’t do the same kind of questioning for the CEO population or for anyone else?”

Morgan added to this point, saying, “CEOs make more than they ever have in the history of this country, and the American workers make less.” He said that this has resulted in workers often being asked to do the impossible.

“Do you think someone making $15,000 a year working full-time has the ability to work their way out of poverty?” Morgan asked. “How many jobs do they have to put together to provide for their family? And they’re supposed to be getting an education while doing that so they can get trained for a better job, but most of the jobs being created are more low-wage jobs, and most of the biggest employers are low-wage employers.”

Morgan also pointed out that if adjusted for inflation since 1968, the current minimum wage would be almost $11 per hour. Wages have gone backward, he said, with “more and more people working very hard for low pay.”

Considering other options

Raising the minimum wage was not the only alternative discussed by the panel. Strain suggested that legislators consider options like the earned income tax credit to improve the lives of low-wage workers.

“There’s no debate among economists about what happens to employment when you increase the earned income tax credit,” Strain said. He added that while the credit costs taxpayer money, it “has significantly raised employment among individuals who previously weren’t working.”

Other panelists argued that governmental bodies already spend on subsidies for businesses and support for low-income citizens, and that more responsibility should now rest on businesses.

“You can’t tax people enough to offset the fact that the biggest employers don’t take responsibility for what their workers are being paid,” Morgan said. “How are you as a state legislator going to offset the fact that you have whole industries in your district where people are making tons of profit while your constituents are making minimum wage?”

Strain disagreed, saying, “The minimum wage is not the only answer. The minimum wage has controversial effects and, most importantly, does not marshal social responses to meet this social goal.”

Wedo added that raising the minimum wage too high too fast would harm companies and drive their business away from states with high wages, disadvantaging constituents and losing jobs.

“It just doesn’t make any sense to operate in a town where you can’t make any profit,” Wedo said.

Furman said that this policy is akin to putting communities in “handcuffs,” forced to make only policies that attract businesses at the expense of environmental and labor standards.

Wedo then discussed his own blue-collar background and subsequent rise to CEO as evidence that the current system in place helps individuals to follow their dreams.

“We have a proven system in America. The magic of the free enterprise system does work,” Wedo said. He urged policymakers to team up with businesses in their regions to “unlock the Canadian and American entrepreneurial spirit driving new enterprise.”

Morgan was more skeptical of the current system’s ability to solve problems, saying that low-wage jobs have increased, and “the jury is in” on how employers will decide what people make.

Panelists praised

The panel then took questions from the audience, many of whom were former business owners who shared their own experiences with minimum wage.

At the discussion’s end, Weber applauded all of the panelists for their principles-based discussion, adding that he recognized that they have a common goal, just different ways to achieve it.

“We heard differing viewpoints, but all four of these people have in their minds the same kind of outcome that we would like to achieve,” Weber said.

Weber stressed the importance of continuing this discussion with other audiences and policymakers. He said that audience’s interest in the panel is a recognition of the roles that legislators play and the impact that they have on so many lives in their states.

“These are four people who shared their deep experiences and some tremendous insights with us today,” Weber said.

Article by Sunny Rosen

Photos by Lane McLaughlin