Lessons from Lauder

Executive chairman of The Estée Lauder Companies discusses dual class structure

8:55 a.m., Nov. 4, 2013--When Estée Lauder founded her business in the mid-1940s, it was all in the family; the company sold cosmetic and beauty products directly to salons and hotels.

Fast forward five decades and her children and grandchildren took over the family business. But when they decided to open it to public investors, one of the first things they had to do was address the corporate governance.

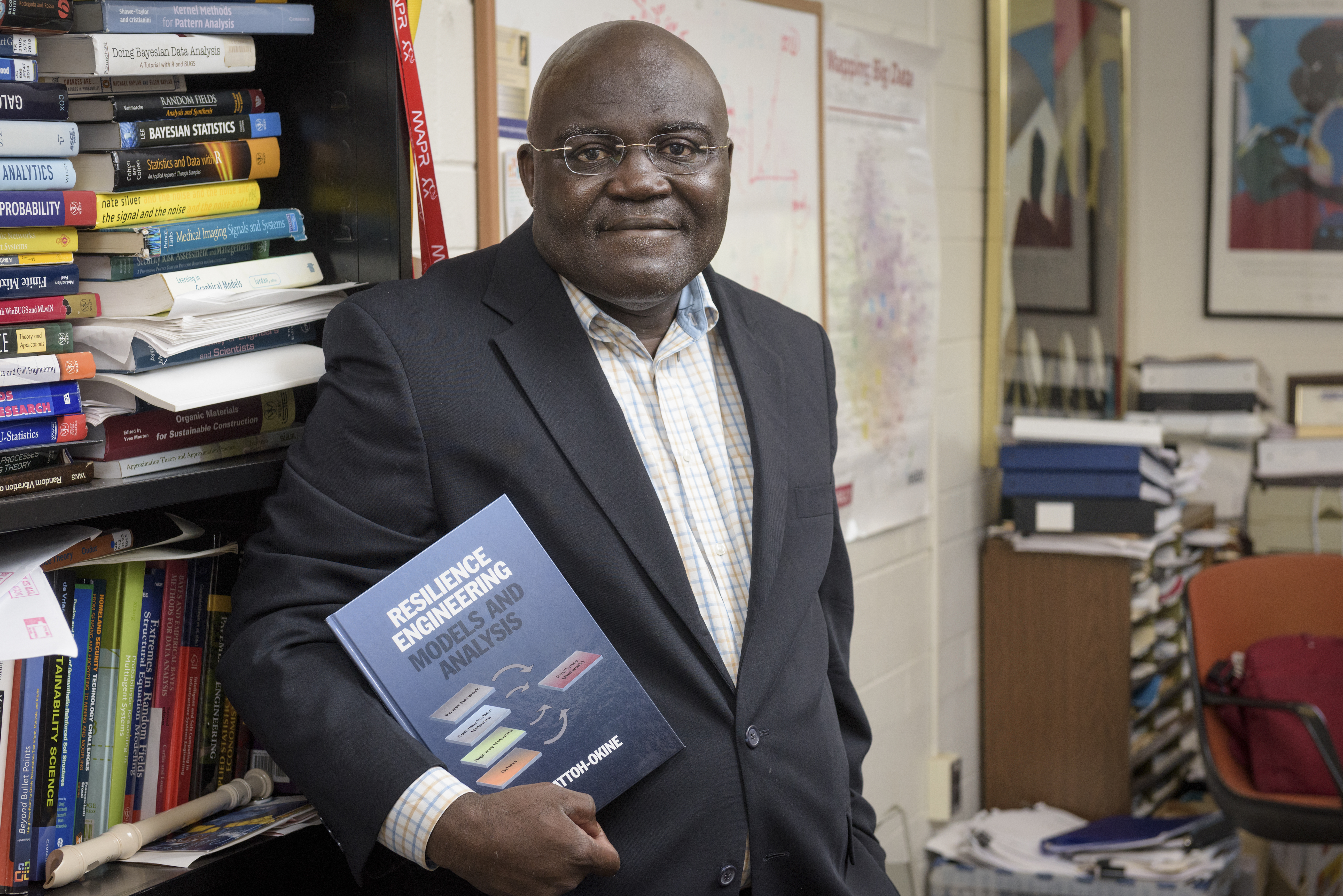

People Stories

'Resilience Engineering'

Reviresco June run

“By going public we accomplished a couple things long term,” said William P. Lauder, executive chairman of The Estée Lauder Companies. “First of all we cleaned up the internal corporate governance structure. No longer were board meetings also known as Thanksgiving dinner.”

They also grew the company with attention to public investors, but were careful to maintain a long-term attitude toward investing.

“We needed to learn how to manage in this environment,” said Lauder. “Our management team was really expert at our business but not this one aspect.

Avoiding “fashion” of the moment investment decisions based on a short-term focus was one of the key drivers for the family in deciding upon a dual class structure, said Lauder, or one in which the public has shares with less voting power.

To shed light on how such a controlled structure can influence the board and governance of a company, Lauder fielded questions from Charles Elson, director of the John L. Weinberg Center for Corporate Governance, during a Distinguished Speakers Series event held Tuesday, Oct. 22, on the University of Delaware’s campus in Newark.

“Because of its sunset provisions, among dual class structured companies, The Estée Lauder Companies is one of the best," said Elson, “so the question becomes how does the governance structure play in to this highly successful operation?”

For Lauder, maintaining some control within the family has meant better financial management through difficult economic times.

“Prior to the last economic recession there was an extraordinary fashion in the financial industry of leverage,” said Lauder. “If you didn’t leverage your balance sheet to the right level, you were not properly structured.

“But I’d look and say, I’m in a business that’s all about cash. If we don’t have enough we’ll be out of business. Why take on leverage and feed the beast, the debt, prior to feeding the most important part of our ecosystem which is the consumer?”

Along came the recession and according to Lauder, “All of a sudden, our underleveraging looked really good and we weathered the storm fairly well.”

He credits this as one benefit of having a controlled structure where a shareholder community with their own priorities and interests didn’t trump the long-term interests of the business.

As for dividing responsibilities between his role and the non-family CEO and relating an overall picture of how the board functions, Lauder said there are areas each side independently handles but there are also instances of overlap where they spend time talking through issues.

“It’s successful because we get along,” said Lauder of the president and CEO Fabrizio Freda. “Before he ever arrived we spent a great deal of time talking about and defining the roles and responsibilities each of us would have, what was down the middle, and what we’d consult on so there was nothing we’d come back and say why did you do that? We got into alignment pretty quickly.”

When Elson asked if Lauder were given a choice to invest between two companies whether dual class structure would be a factor in his decision, Lauder said it had less to do with the capital structure and more with the management.

“Number one would be quality of management, number two quality of alignment, and number three economic market conditions in that industry, room for growth and expansion opportunities in future markets and whatever obstacles they may face,” said Lauder.

When asked about the relevance of capital structure, Lauder said it was more a matter of whether the company had enough equity, enough growth and a clear enough story.

“If management’s good, it’s going to be a good company,” said Lauder. “If management isn’t good, dual class or not, it’s not necessarily going to be a good investment. The company’s equity, growth – that is a far more compelling story than dual class or not.”

And when it comes to public perception of family members in key roles, Lauder aimed to dispel the perception that by definition, a family member is not a professional.

“The fact of the matter is, just because your name is the same as the people who own the stock doesn’t mean that you’re not professional,” said Lauder.

Added Elson, “I think the point is that it should not be an automatic qualifier nor an automatic disqualifier. You should evaluate someone individually based on talent. The problem is that it muddies the water and the perception.”

Panel discussion

Following Lauder, a panel discussion focused on how directors of controlled corporations can most effectively carry out their fiduciary duties and the governance of a controlled corporation.

Moderated by Elson, the panel included a number of corporate governance professionals as well as managing directors and law professionals who reviewed a paper by Ronald J. Gilson, Charles J. Meyers Professor of Law and Business at Stanford Law School and Marc and Eva Stern Professor of Law and Business at Columbia University School of Law.

A number of panelists suggested that the role of the board in a controlled company was to act as a check and balance system to ensure the verification of good work.

Some also agreed that showing deference to majority shareholders could make good economic sense because they have “skin in the game.”

“Often the board has more information than the shareholders and should be allowed to supervise and oversee management,” said one panelist. “But we are active owners and like to express our thoughts and opinions through the mechanisms provided to us by state and federal securities laws.”

Another suggested that while showing deference to majority shareholders could be beneficial, “you also want to be able to break the glass when situations go awry.”

For Gilson, separating deference from balance is key when looking at directors of controlled corporations.

“Panels like this can provide a clear message as to how independent directors can act with integrity, which will continue to be important as this is a growing issue.”

Article by Kathryn Meier

Photos by Kathy F. Atkinson