Social Security

UD professor helps solve the Social Security retirement puzzle

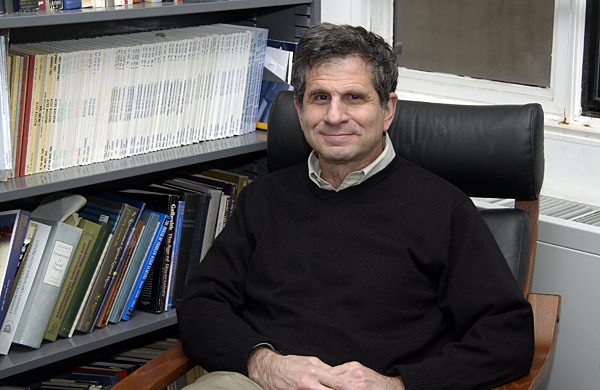

9 a.m., July 27, 2011--Can’t wait to claim your Social Security retirement benefits? Think you’ll get the most by claiming your benefits as soon as possible, at age 62? Think again, advises Jeffrey Miller, partner at Social Security Choices, a firm dedicated to helping individuals understand how to maximize their Social Security benefits.

“Consider us the H&R Block of Social Security,” said Miller, who is also professor of economics in the Alfred Lerner College of Business and Economics. “Here’s a very complicated government program and we’ve designed a way to help guide you through it.”

People Stories

'Resilience Engineering'

Reviresco June run

Miller, who thought his professorial role and knowledge of economics would serve him well when it came time to make his own decision about claiming Social Security, quickly realized a surprisingly wide array of claiming choices coupled with a lack of customized help on a case-by-case basis made for a difficult decision-making process.

“To give you an example, a married couple must choose from among roughly 400 possible claiming options, with many involving complicated strategies for maximizing benefits,” said Miller. “Confronted with such a bewildering number of choices, many people tend to rely upon some simple decision rules, such as ‘claim benefits as early as possible’ or ‘claim benefits at the full retirement age.’”

But such rules of thumb usually lead to costly errors. In fact, noted Miller, of the nearly three million seniors who claim Social Security benefits each year, most fail to make choices that will maximize the lifetime value of their retirement benefits, leaving tens of thousands of dollars on the table.

Further, Miller’s research found that a very limited amount of useful help is available to seniors on an individualized basis.

“The Social Security Administration is surprisingly unhelpful in connection with the claiming decisions facing individuals,” said Miller. “It is well-documented that Social Security representatives all too often simply give prospective claimants incorrect advice.”

So why not turn to a financial adviser to help you make the best decision?

According to Miller, such advice is costly and often not especially helpful.

“Some financial planners tell clients to contact the Social Security Administration for advice about their claiming issues,” said Miller. “After all, many financial planners earn much of their income by selling financial products like annuities. They earn nothing from advising clients about Social Security matters.”

In order to help seniors avoid such costly mistakes and poor claiming decisions, Miller and the team at Social Security Choices developed a unique software tool that helps to solve the Social Security retirement optimization problem at the individual level.

A custom analysis – for single, married or divorced persons or widow(er)s – provides seniors with clear directions that explain which benefits they should claim and when in order to maximize the lifetime value of their Social Security retirement benefits.

“For all possible claiming ages, we show how much lifetime Social Security income is forgone by choosing any non-optimal claiming pattern,” said Miller.

The best part of the analysis, noted Miller, is that it takes into account the senior’s specific circumstances.

“Unlike the ‘one-size-fits-all’ financial advice columns, our analyses and reports are customized for each client,” Miller explained.

Sound too good to be true? Miller encouraged seniors to view a sample report offered by Social Security Choices to see how small, subtle differences can have substantial effects on the benefits they will receive.

“As far as we’re aware, no other institutions are offering this information for free,” said Miller. “We’ve even checked with the chief actuary at Social Security for clarity and to get the facts straight.”

Miller and his partners also share some “secret strategies” that can help increase your lifetime Social Security benefits.

For example, if you are divorced and not remarried, you may be aware that divorcees may be able to claim benefits on their former spouse’s earnings record provided certain requirements are met.

What you probably don’t know, said Miller, is that divorcees who qualify for benefits receive more favorable treatment from Social Security than do spouses.

“If a spouse wants to claim spousal benefits, then the other spouse must also claim their own retirement benefits,” explained Miller. “But as a divorcee you do not need to wait until your former spouse claims his or her retirement benefits. As long as your former spouse is eligible to claim retirement benefits, then you may be able to claim divorcee benefits.”

Miller also explained that the firm’s website and report can help seniors understand other strategies, like file-and-suspend for married couples, or that claiming at 66 is usually a bad idea for singles.

“We’re not dealing with Medicare or disability,” noted Miller. “But if you are looking for retirement help, our 52-page, inflation-protected, custom free report is bound to help you understand your optimal strategy for claiming your Social Security benefits.”

Miller, who earned his doctorate in economics from the University of Pennsylvania in 1976, worked at Social Security after graduating from college. He has published numerous papers in peer-reviewed economic journals.

Other partners at Social Security Choices include William Dowd, a 2009 economics and international relations graduate of the University of Delaware; Russell Settle, retired University of Delaware professor and Social Security beneficiary since 2009; and Ellis Wilson, doctoral candidate in computer science at the Pennsylvania State University and computer programmer for the firm.

Their work was featured in a July 26 Bucks blog entry in The New York Times.

Article by Kathryn Marrone Meier